Welcome, welcome

So, hell of a week, eh? Hopefully your portfolio came out of it in the green! Some community members weren’t so lucky.

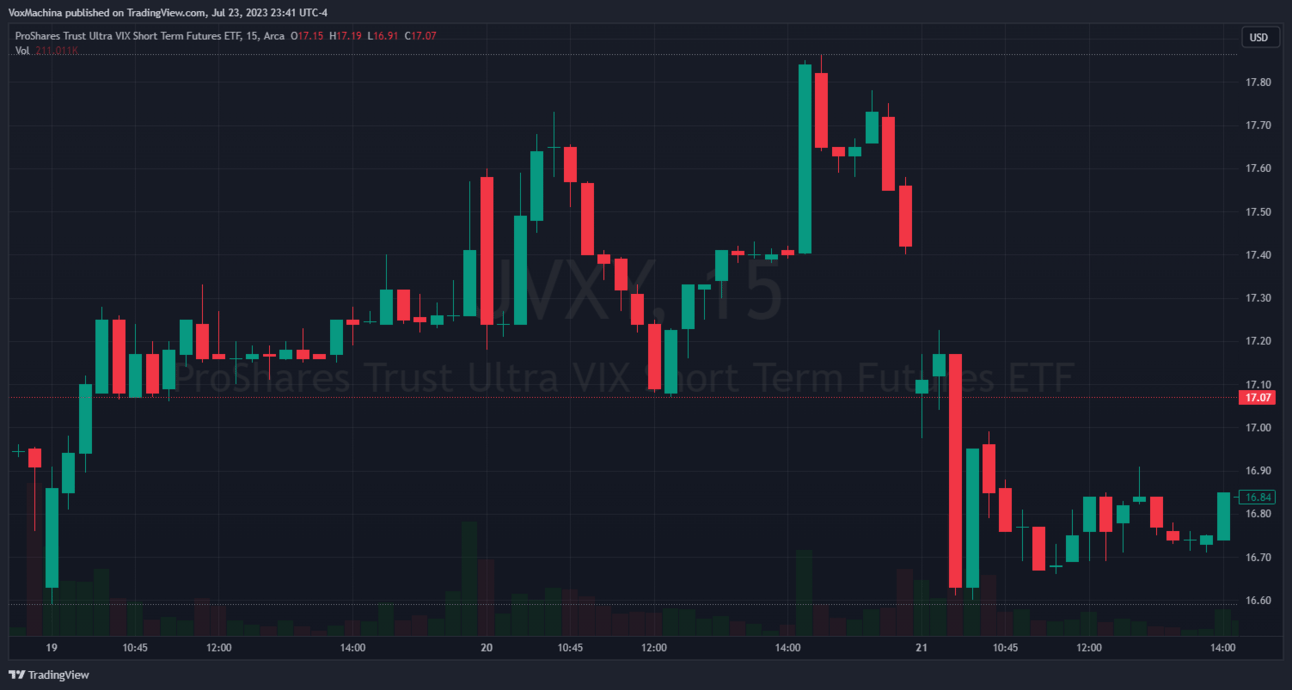

Just kidding, almost everyone who posted came out on top of the markets over the two days the “Overbought QQQ = Buy UVXY” logic tripped. UVXY was up ~5% over the two days, as opposed to QQQ being down roughly the same amount. That’s a huge win in my book.

It does however bring up the topic of “Diversity.” Lets ask ChatGPT for a definition.

Diversity in investing refers to the strategy of building a varied portfolio by allocating investments across different asset classes, industries, regions, and financial instruments. The fundamental principle behind this approach is to reduce risk and enhance potential returns. By spreading investments across various sectors and markets, investors aim to mitigate the impact of any single economic event or market downturn. This diversification can include stocks, bonds, real estate, commodities, and more. The goal is to create a balanced and resilient investment portfolio that can weather market fluctuations and take advantage of opportunities in different sectors. Emphasizing diversity helps investors achieve a more stable, long-term growth trajectory and minimizes the exposure to undue risk, thereby increasing the chances of overall financial success.

Thanks ChatGPT

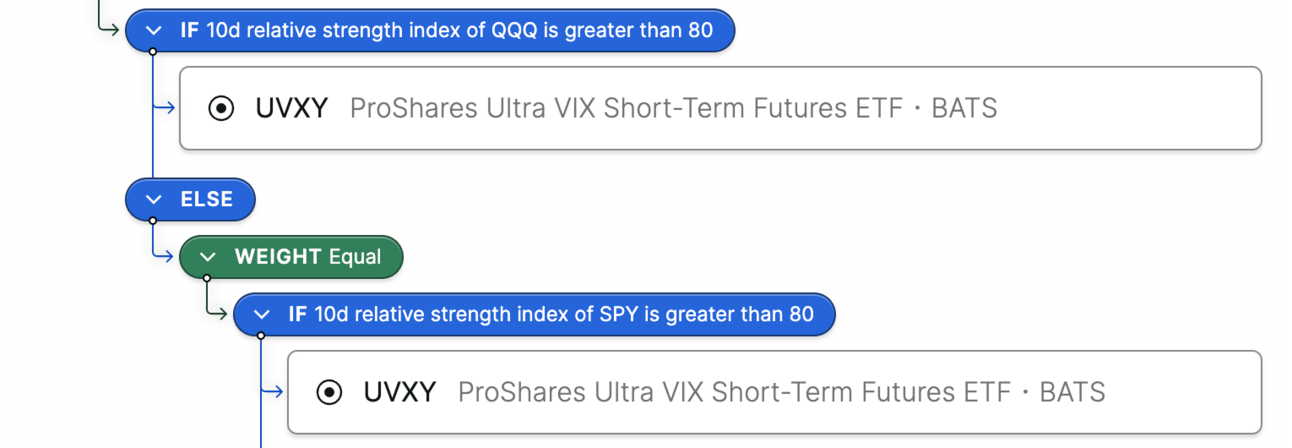

Upon asking what everyone was triggering to get so heavily in to UVXY, turns out a lot of people run TQQQFTLT and its variants, or use the same two logic blocks in their own strategies, because they work very well historically.

Probably close to half the symphonies here have these 2 checks (or some slight variation of them). 10d RSI QQQ > 80 probably would have bought UVXY today for most people, regardless of trade time 10d RSI SPY > 80 almost fired as well (I think it dipped below 80 by the time trades were executed however) A few variants even use 79 as the threshold. A few use TQQQ as the trigger instead of QQQ as well.

So, it worked out in our favor this time, but slamming most of your portfolio into a single highly volatile asset is a terrifying concept if you weren’t born and bred in WallStreetBets.

“ You merely adopted the red. I was born in the red, molded by it. I didn’t see Green until I was already a man. By then, it was blinding!”

Overfitting: Does this count?

Well, technically it does. You’re slamming the whole symphony into something that has historically correlated. No guarantees it will in the future. But, until something drastically changes with the roughly 2:1 success ratio, we’re all good.

It works until it doesn’t basically.

This newsletter is long and stupid, give me a summary.

Rude, but okay.

Double check your strategies before you invest in them. Go over them line by line. Read the logic. Understand the logic. Embrace the logic. Compare the logic to other strategies you’re invested in or researching. Make sure you don’t risk a “Cluster Failure” because a simple and predictable thing happens one day. Even an unpredictable one. Minimal overlap is the best overlap!

If all of that sounds way too vague, check out the Discord post linked below. Its an extremely thorough, high quality methodology one of our O.G. members uses himself before deciding to invest in anything. Can’t recommend internalizing the message enough.