Genesis Portfolio

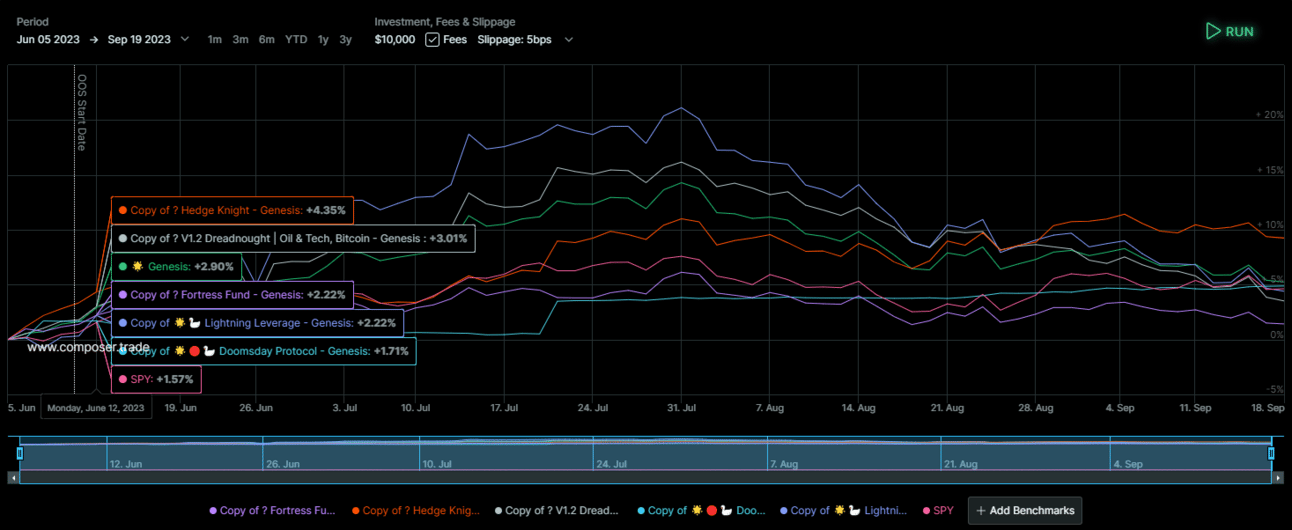

We’re here again with the third and final installment of the Genesis Launch Portfolio. Lets start off with an update screenshot of the Out of Sample Returns.

There is clearly some correlation in returns amongst a great many of the symphonies included. However, a standout performer in choppy markets has appeared to emerge, The Hedge Knight!

If you haven’t yet, join our Discord!

I’d like to take this time to thank anyone who’s been with us for the last year, through the twists and the turns of the market, we’re super excited to see where the next year takes us. Even more so, we’re hyped to see the new generations of strategies the community can come up with!

Now, lets recap Genesis so far;

Strategies are listed from MOST RISKY to LEAST RISKY;

🌟 Dreadnought | Oil & Tech, Bitcoin

🌟🦢 Lightning Leverage

🌟 Genesis

🌟🦢 Hedge Knight

🌟 Fortress Fund

🔴🦢 Doomsday Protocol

Today we’ll be looking at the following symphonies;

🌟 Genesis .

🔴🦢 Doomsday Protocol.

Let get to it!

🔴🦢Doomsday Protocol

Like all good things, everything must come to an end. We choose to end this Launch and newsletter with Doomsday Protocol. Hopefully, with Doomsday Protocol, your portfolio won’t find it’s end anytime soon.

Doomsday has one focus in mind. Preventing your portfolio’s death to Black Swan Events. We’ve combined 3 Black Swan Catchers into one rebalancer. I’ve personally gone through these logics and considered them sound in their design and theory. One of them I designed myself, “Black Swan Catcher V4”.

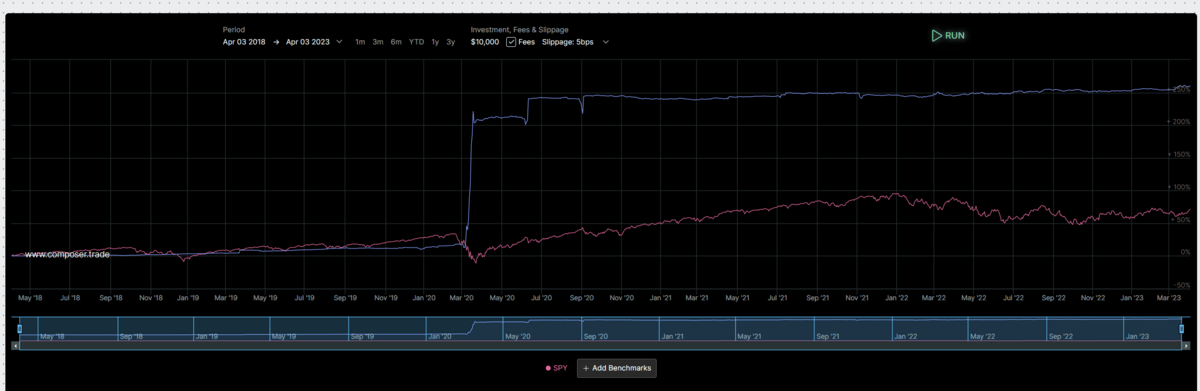

As you can see in the backtest, this rebalancer is designed to only activate during specific types of market crash like Covid in March of 2020, 2008 Global Financial Crisis, or 1987’s Black Monday. Other than that, it more or less goes sideways as it sits in short term bond ETF’s.

How you use it

Black Swan Catchers should be typically set to only 1-3% of your total portfolio value or inserted into a strategy as a rebalancer of 1-3%. Think of them as buying theoretical insurance. Again, big emphasis on THEORETICAL. Unfortunately there haven’t been very many market crashes since Composer has come online, so live testing is rather difficult. This is why we mark all our black swan catchers as highly theoretical and not guaranteed to work.

Risks

Completely Theoretical

As we’ve stated multiple times in this newsletter, black swan catchers are educated guesses at best. You shouldn’t rely on any of them to work exactly as the backtest shows, or to catch every black swan event. Fortunately if you’re smart with your position sizing and only put 1-3% of your portfolio in a symphony like this one, the downside risk is minimal, especially when you consider the typical market crash results in 30-60% loss in value of the SPY.

The upside potential though if they do work can drastically increase your portfolio value over a 20-40 year time frame. If they offset a portfolio loss of even 10%, that is a massive gain over a decade.