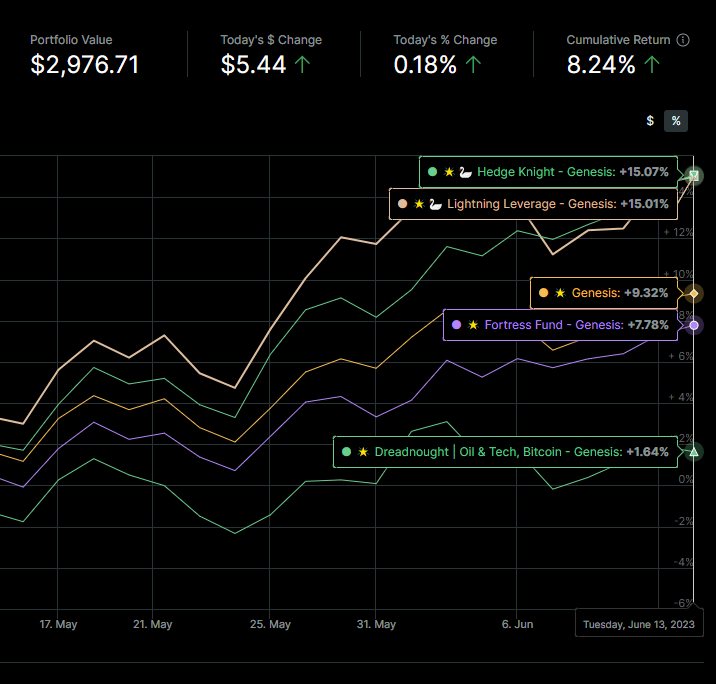

2 Month Performance

Genesis Portfolio Launch

Welcome to the 2nd Edition of our premium newsletter!

Check out Article #1 Here and receive the first two strategies;

Lightning Leverage

Dreadnought.

Today we are looking at

Hedge Knight

Fortress Fund

We wanted to create a strategy that had a nice blend of aggressive and defensive capabilities. Like the Knights of yesteryear, this strategy can mount a balanced mix of offense or defense.

The Hedge Knight focuses on a balanced portfolio allocation rather than having specific sections of focus. We wanted to combine some of the FTLT variants with the more stable and simple strategies for a total blend. Then we topped it off with a 3% Black Swan Catcher.

Who is the Hedge Knight for?

Hedge Knight was created with balanced simplicity in mind. The strategies used are reasonably diverse, relatively simple to understand, and proven effective in current market conditions.

Strategies used

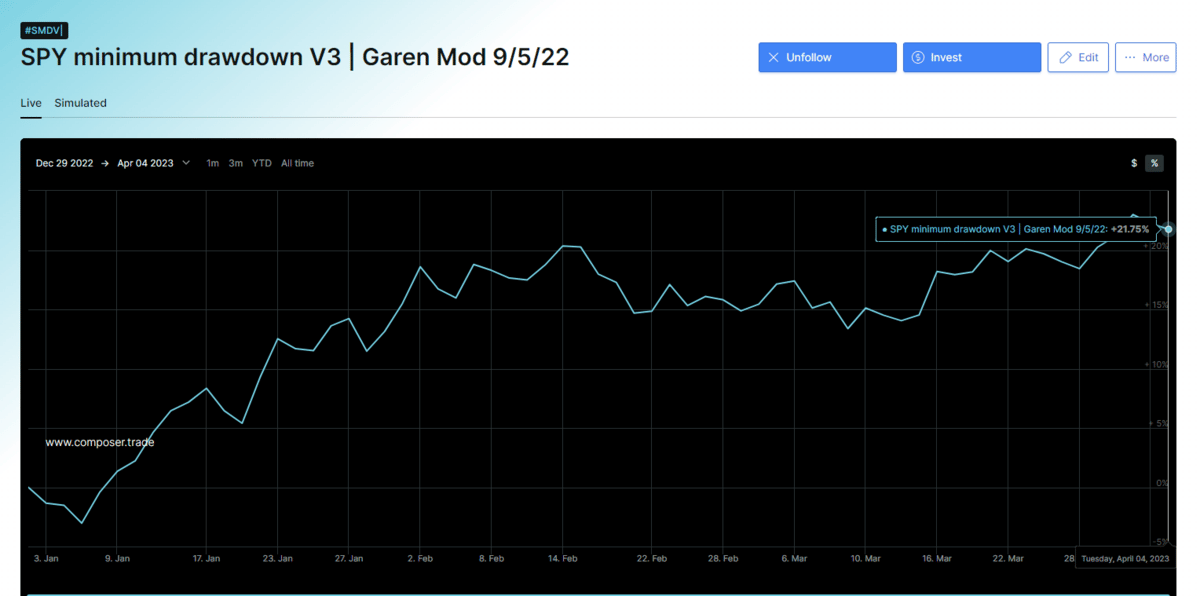

One strategy we haven’t spoken about in this newsletter is the “SPY minimum Drawdown V3” which I actually designed myself back in September of 2022, I even created a YouTube video on how I built it which you can view below.

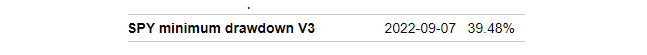

“SPY Minimum Drawdown V3” is a rebalancer in itself. We’ve been tracking it live since September of 22’

Unfortunately the Live chart data only goes back to Jan 3, 2023 but here is the past 4 months (It’s 4/4/23 as of writing this).

In that 4 month period though SPY Min DD V3 has had an amazingly low Drawdown of only 5.8%. This is the power of combining multiple strategies into a rebalancer.

Risks

Black Swan Catcher

As we’ve stated earlier in the newsletter, black swan catchers are all theoretical in design and there is no guarantee they will work when the crash eventually comes.

FTLT Framework

There is a concentration of this framework across most branches of the symphony. There may be a day where this framework doesn’t function as well as it currently does.

Want to learn to design strategies like these?

Let us help you learn every nuance of algorithmic design. We’ll teach you the best practices of what makes a great algo and a terrible one that will lose you money. Investing is hard enough to learn by yourself, algorithmic design is even harder. Stop pretending you know what you’re doing and let us show you the way!

Symphony Link

Here’s the link to use Hedge Knight