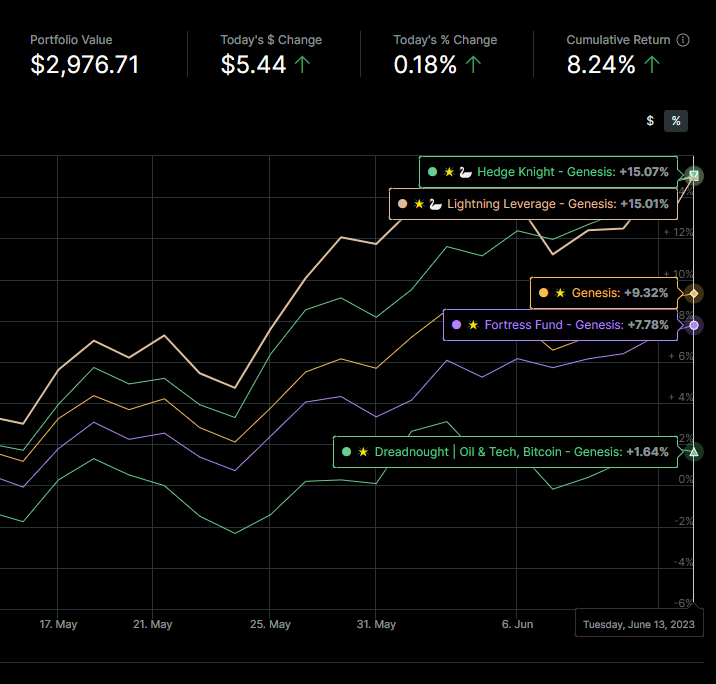

2 Month Performance

Genesis Portfolio Launch

Welcome to the 1st Edition of our premium newsletter! Today I am going to introduce you to TWO of the SIX custom built strategies you’ll be receiving in your premium subscription. Each one can act as a portfolio in its own right. You can use all of them, or select the ones that fit your personal goals and risk tolerances best.

If you haven’t yet, join our Discord

Since this is the first edition and launch of the premium newsletter I am titling this launch Genesis. Here are the 6 strategies we have put together for you. However, let us explain to you how these were designed, before you start putting money in places you don’t yet understand!

Strategies are listed from MOST RISKY to LEAST RISKY;

🌟 Dreadnought | Oil & Tech, Bitcoin

🌟🦢 Lightning Leverage

🌟 Genesis

🌟🦢 Hedge Knight

🌟 Fortress Fund

🔴🦢 Doomsday Protocol

Today we will be looking at

🌟Dreadnought

🌟🦢 Lightning Leverage

Individual Strategies

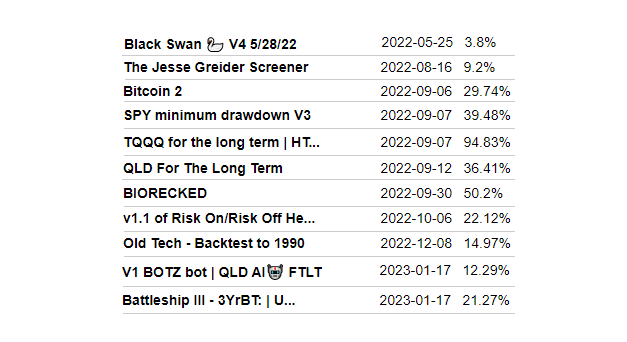

The Genesis Rebalancers have been built from the best preforming strategies created by the community! I personally threw $50 into around 40-50 strategies for the past 6 months to see which ones worked and which failed. If you’d like to see the full list of strategies in this test portfolio here are the returns as of writing this on 4/2/23.

Criteria for selecting these strategies

MUST be tracked with LIVE MONEY! NO PAPER TRADING trading or simulations.

Longest running strategies available.

Positive gains.

Started during the bear market (SPY below 200D MA)

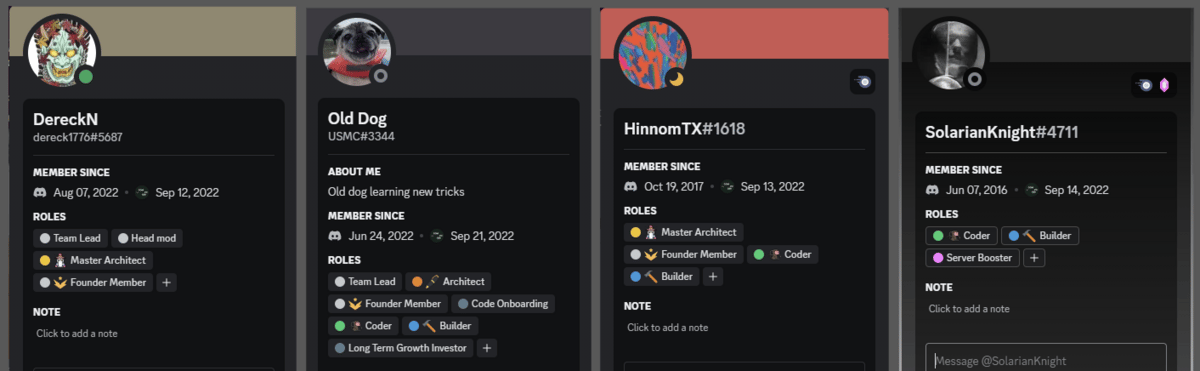

Here are all of the individual algorithms used in Genesis launch.

If you would like to talk directly to the Architects who built these algo’s here are the creators. Just @ them on discord to get ahold of them.

Dereck Nielsen

dereck1776#5687

QLD For The Long Term

Garen Phillips

Dzuari#3950

Black Swan V4

SPY minimum Drawdown V3

Jesse Greider Screener

V1 BOTZ bot | QLD AI🤖 FTLT

Garen Phillips- Dzuari#3950

Dereck Nielsen - dereck1776#5687

HinnomTX#1618

TQQQ for the Long Term v0.4

kfishstix#5908

BIOWRECKED

SolarianKnight#4711

v1.1 of Risk On/Risk Off Hedgefundie (No K-1)

USMC#3344

Battleship 3

Ken Luu

Bitcoin 2

Unknown

Old Tech - Backtest to 1990

Now lets dive into our first Genesis Rebalancer.

Want to learn all there is to know about Markets, Money, Trading Psychology, and Algorithm Design?

Use code LAUNCHSPECIAL for 30% off!

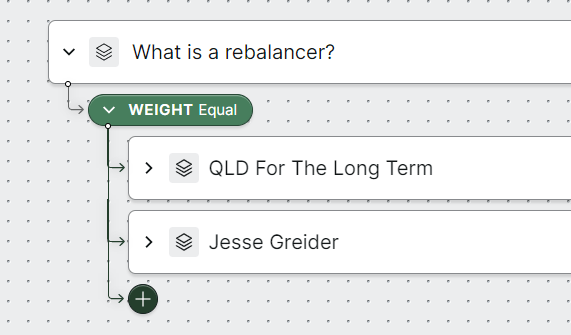

But first, what is a Rebalancer?

If you are new to the specifics of Composer and our community, these strategies are all known as Rebalancers. A rebalancer has multiple small strategies inside it that shift capital back and forth depending on the performance of one branch versus another. As one strategy goes over it’s assigned weight, some capital gets shifted to one that may not be performing as well at the moment. This creates the same effect as “Dollar Cost Averaging” into an asset.

For example, here is a simple rebalancer.

Combining uncorrelated assets or strategies together has shown to reduce the overall volatility of a portfolio and can even increase long term gains if done correctly. Please watch this video if you haven’t see it yet. This strategy will rebalance any time a logic gate is triggered or any asset grows/falls more than 3% in value.

You may have noticed the “Premium Newsletter” tag on the strategies. We combed through every strategies logic and removed any unnecessary K1 issuing ETFs, possibly dangerous logic branches and removed/switched any low volume tickers. We also boosted some branches volume with more tickers.

🌟 Dreadnought | Oil, Tech & Bitcoin

Dreadnought pays homage to it’s predecessor Battleship III designed by USMC#3344. This strategy has the heaviest weighting of Battleship III of any of the 6 Genesis Rebalancers. We combined Battleship III with the most aggressive FTLT variants used in Genesis to amplify it’s firepower to deliver devastating results.

We wanted to take two different sides of the markets, Technology and Bitcoin, which have very high betas to SPY, and combine these powerhouse strategies with a commodities based strategy. The two extremes of the focus should balance each other well.