Good Morning Hard Road fam.

Actual footage of Jake waking up in the morning

We've got a busy week ahead of us, lets go over the menu and dig in shall we?

The coming weeks economic calendar.

Yall ever heard of Peter Zeihan?

Is the world actually ending? (probably not but lets hear him out.)

We hosted an open conversation with the founders of NEOS Funds.

What is going on with Bitcoin?

Multiple Economic Data releases are coming this week. Mark your calendars for Wednesday at 2PM EST!

Wednesday - FOMC Meeting + Press Conference. What will JPOW make the market do this time?

Thursday - Jobless Claims.

Friday - Unemployment Rate.

There is going to be plenty to talk about next week, but for now lets see how the market digests this round of Fedspeak. My bet is regardless of whether we get hawks or doves, the only safe prediction is chaos, as always.

Have you folks heard of Peter Zeihan?

He's a Macroeconomic strategist, author, and just all around pretty smart dude. He makes some pretty extreme predictions about the world and where its headed regarding food, energy, and the idea of De-Globalization. For reference, here is a clip from a recent interview he did with Joe Rogan about the "population Bomb" coming for China in the next decade. That doesn't exactly paint a pretty picture for the Red Dragon if you ask me. The quick version is of his economic points is that we're looking at a complete demolition of the global order as we know it. Isn't this exciting!

To back it up a little bit, this all means two things,

1 - His editor needs a raise because the name of his most recent book, "The End of the World is just the beginning" could not possibly be named better given the topics at hand. The scale of the shakeup in the global order that the idea of China no longer being "The Worlds Factory" represents cannot be overstated.

2 - The United States is uniquely positioned to benefit from this shakeup in global order (shout out to all the history nerds having Breton Woods Agreement flashbacks hearing that.) We have our own internal issues to sort out, with a looming recession and inflation still not back to its 2% target, but Zeihan details how the US is set up to be one of the safest places to be doing business in the next 10 years, assuming we don't eat ourselves alive. Fingers crossed we make it.

Specific attention should be paid to what we're good at making right here in the old US of A. We're a net food exporter, could be a net energy exporter if it was economically viable, our workforce is one of the most highly skilled in the world, and we've got trade partners that are both miraculously convenient geographically and complimentary to our needs.

Want the source on all this? Unfortunately you'll have to go watch the Rogan interview over on Spotify, this particular clip isn't on Youtube. The whole thing is well worth the listen, in my opinion, even if I completely disagree with him on the topic of Bitcoin. Nobodys perfect, eh?

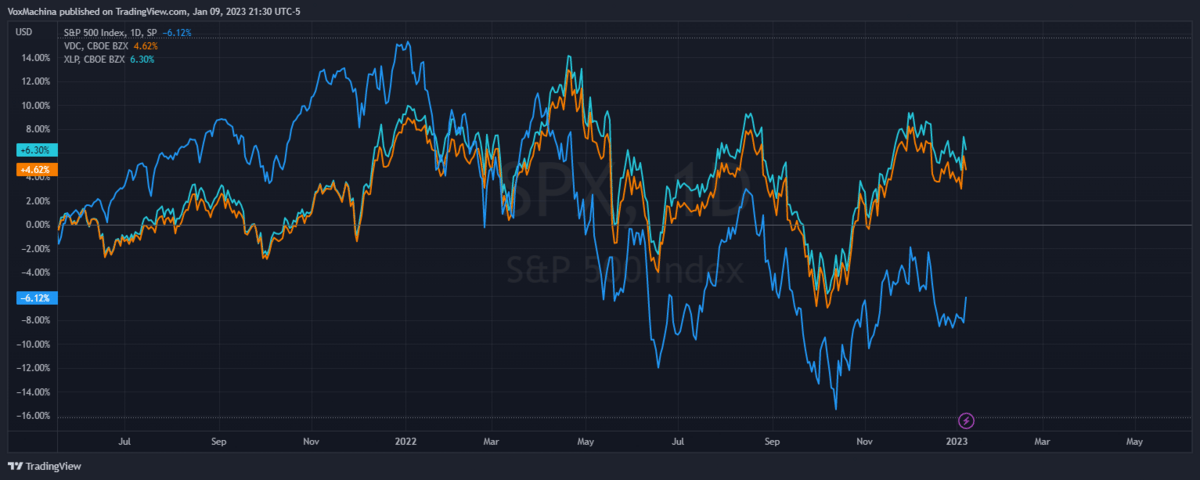

In summary, Domestic Industrials and Domestic Commodities are likely to benefit heavily if their supply chain is sufficiently localized to North America. There is very little risk of food scarcity in the US, considering we're one of the worlds largest food exporters. If Zeihan is correct, then ETF's like $XLP and $VDC and companies that supply critical infrastructure material (fertilizer comes to mind, how has $MOS been doing recently?) should see a large benefit in relation to the S&P500.

As you can see, they've already handily beaten $SPX over the course of 2022, and if the trend and fears of recession come true, even barring any wider instability, they may continue to be relatively safe places to look for outperformance.

Hot off the presses and freshly entered into testing (Caveat emptor, this isn't even running live yet!) A strategy focusing on a couple of the Countries Zeihan picks out specifically, I present to you Around the World! Built off the QLD For the Long Term framework, I swapped out QQQ for SPY to achieve a more broad-market focus, and inserted a basket of select countries and ETF's to begin triggering when the safety of SPY isn't quite as attractive. Keep in mind, this is a work in progress and we'll be revisiting this concept at a later date, so be sure to subscribe and keep an eye out for revisions as we dig deeper into the world of emerging markets!

The Discord Community hosted a call this past week with the founders of NEOS Funds, the creators and operators of a series of Income Generating ETF's. There is a recording posted in the Recorded Calls channel for those interested. Other highly notable guests include Ben Rollert, founder and CEO of Composer, and Donovan, Product Manager at Composer, along with many notable members of the Discord Community.

Check out the recording for an insightful look into the world of managing and building ETF's!

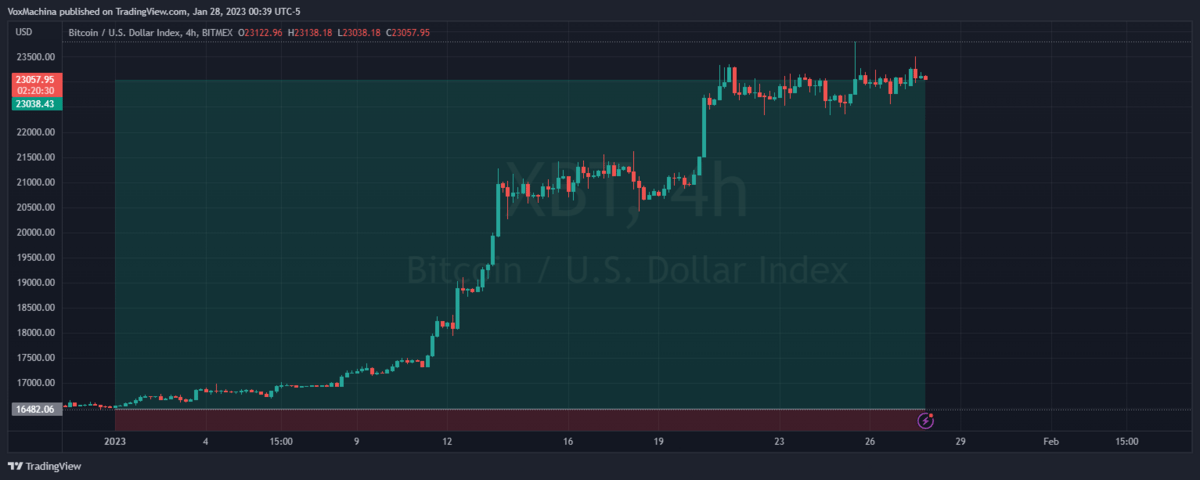

So Bitcoin has taken the start of 2023 as a signal that its time to do Bitcoin things again, and has decided to climb almost 40% Year to Date. The highly logical explanation is that as talk about interest rates leveling off comes to the forefront, market sentiment has seemed to shift to risk on assets.

But why settle for the logical explanation when we can craft a much more exciting and way more sinister situation? Fasten your tinfoil hats ladies and gentlemen!

Its about to get weird.

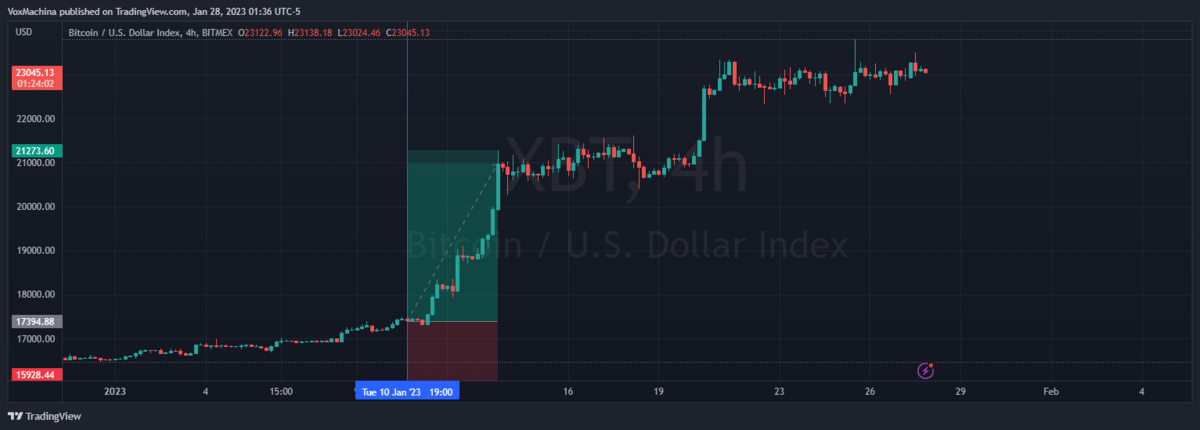

Alright so everyone remember when the NOTAM system went down two weeks ago and air traffic in the US shut down in its entirety for the first time since 9/11/2001? Approximately 4 hours later, the price of Bitcoin began a 3 day march up and to the right that would see it climb to a peak of 30% on the run.

Blue Vertical line is approximately an hour before the outage was publicly announced, the first candle up opened approximately 4 hours later.

This wouldn't be particularly interesting, but when you consider ransomware attacks frequently use Bitcoin as their payment vector (despite, you know, entirely traceable ledger.) Then consider that Matthew Prince, (CEO of Cloudflare for reference), stated at a meeting that 2023 is going to be "a busy year in terms of cyber attacks." The World Economic Forum tends to have meetings and events about things eerily close to when they happen. I'm going to be honest I don't think this is actually what happened, and it doesn't explain the further 10% run-up that happened a few days later. I just noticed some coincidental timing and the pattern recognition kicked in!

Actual Footage of me writing this section

And on that incredibly uplifting note, I hope you all have a good week! Stay safe with all the data and fedspeak, and come hang out with us in the Discord Community and talk about the info as it releases!

Have yourselves a good week!

Please note that the information provided is for general informational purposes only and is not intended to be financial advice. The information provided is not a substitute for professional advice and should not be relied upon as such. Always consult a financial advisor before making any financial decisions. Additionally, The Hard Road staff and contributors may have a stake in the Securities, Cryptocurrencies, Platforms, and other assets that are mentioned in this article and others.