You know what is best in life?

No, Conan, not that.

Listening to knowledgeable people talk about their passions.

Its my absolute favorite part of the community we’re building. The fire memes are great too.

Over the weekend, we had the second of our series of interviews/learning sessions with the Communities Master Architects. This one was with SandyPants, one of the newer Master Architects, but one of the most well read users in terms of finance, trading, markets, and portfolio design that I’ve had the pleasure of interacting with.

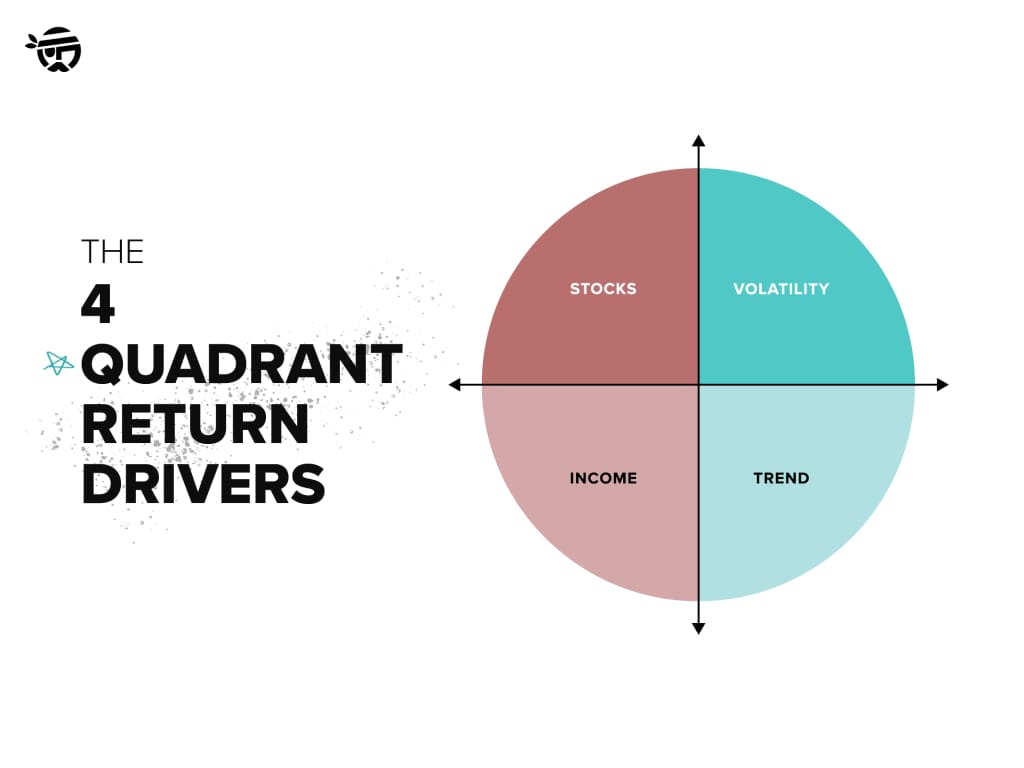

That deep base of knowledge is put on display in his Dragon family of Symphonies. Based on the Dragon Portfolio design principles laid out by Chris Cole of Artemis Capital, progressing through the logic of Dragon Family is a lesson in risk management even without an explanation of the history or theory. Every ticker, every weighting, every logic gate, all carefully chosen. All built with the purpose of weathering, and profiting from, any and all market conditions. Fun fact, The Dragon and The Cockroach are functionally identical in terms of portfolio management philosophies, but vary wildly in their implementation and logic. Link to the Cockroach Newsletter below, for those interested.

The ranged from an overview of Composers implementation of the Dragon Portfolio, arguably Dragon 1 as there are a few logic branches that persisted through multiple revisions of Sandy's Dragons which start at Dragon 2 and was the focus of discussion in this meeting. During the thorough breakdown of the logic and differences between Dragons 1 and 2, we discussed the philosophy of portfolio and risk management, and briefly touched on one of my favorite analogies relating to trading that I've ever heard.

Imagine the stock market as a highway, full of cars and trucks, going slow and going fast. You can see there is money out in the highway, all different kinds of bills and quantities. The problem is there are vehicles constantly whizzing by. You're also not the only person who sees that 100$, so you've got to be quick, but also very careful to not end up dead. In this analogy, the money in the highway is the alpha of our trades. The cars represent the risk we take when trying to capture that alpha. How fast the cars are going relates to the relative safety or reliability of a trade. You can fit almost any statistic or concept in trading into this analogy. Want to understand standard deviation? Think of a car in a lane moving much slower or much faster than the other sharing the lane, it creates a gap. And that gap creates an opportunity for you to sneak in and grab the money. Seriously, anything you think of can fit. It's my favorite and I love it.

It was a very productive hour, my less-than-1000 word newsletter cannot begin to do it justice. We discussed a great many things from how to prevent overfitness (A personal favorite topic of mine,) what diversity truly means and how your portfolio probably isn’t as diversified as you think it is. We even tried to play a game of “what fund managers are truly knowledgeable and who sucks” but Sandy didn’t seem to want to “throw shade” at anyone as the kids say.

It's a long video, clocking in at an hour, but it is well worth the time. Crank it up to 1.5x if you want to shorten it up a bit, the content is well worth the investment in my opinion!

In the news, we've got a big week ahead of us. Markets are closed Monday in observation of Juneteenth, Fedex is reporting earnings Tuesday After Market Close. They are a well-known bellwether for the ecommerce market and economy in general, so lots of eyes will be on them. JPow will be on Capitol Hill Wednesday and Thursday for his semi-annual testimony to the Senate and House of Representatives. Should be an exciting week, I'll see you in the Discord!

Interesting Twitter Thread of the week.

Looking for a deeper dive?

Check out Garen’s in-depth course, or 1 on 1 coaching!

Bonus Link for those who made it this far.

A community member made an AI summary of the meeting, and it actually managed to capture a lot of the interesting points in much shorter form than I’d consider a replacement for watching, but its really cool to see what AI is becoming capable of!