Morning Hard Road fam, lets get to it;

Heres what we've got on the menu for this week;

The 3 Fund Portfolio died in 2022.

ChatGPT is still revolutionizing society.

When in Crypto, trust no one.

We've got our first Symphony created by the Discord Community to show off.

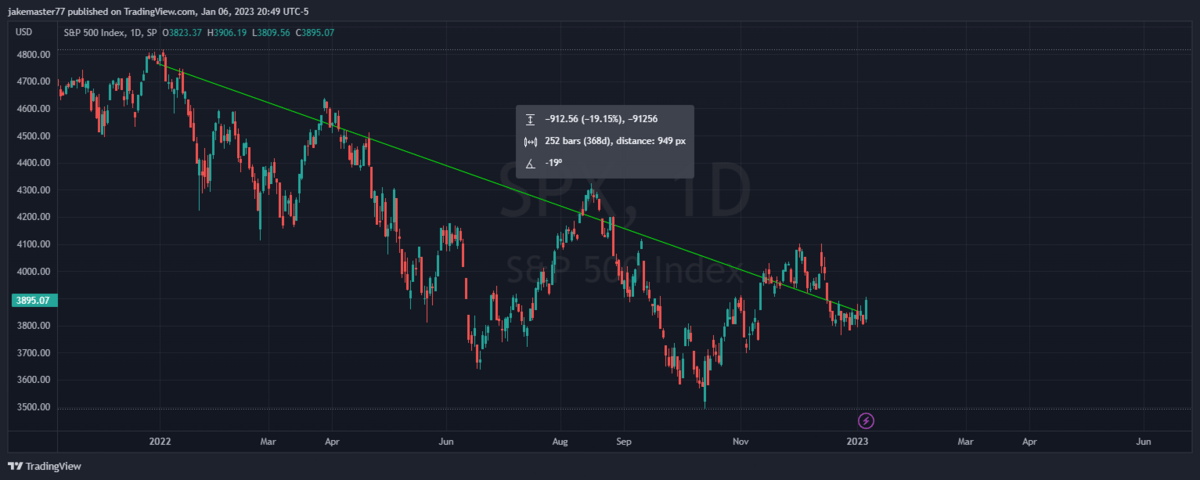

So, 2022 was the S&P 500's worst year since the 2008 financial crisis.

2022 just wasn't a great year for a lot of people, indexes weren't spared from the bloodbath. With a 19.4% drop for the year, the S&P 500 put a pretty big hurt on basically anyone holding it. To make matters worse, the Bond Market also had one of its worst years on record, the worst since 1969 in fact. Its been a while since we've been in a "Rising Rates, Rising Inflation" environment to quite this degree, lots of young investors got their first taste of blood this last year.The folks over at /R/Bogleheads are actually taking it in stride, despite the worst year in history for the 60/40 portfolio, while /R/HFEA is in absolute shambles. Its the classic tale of playing with leverage when you aren't ready.

Actual footage of the average HFEA portfolio

OpenAI 29 Billion Valuation, in talks with VC firms, rumored

There aren't many details of the proposed deal, but it is rumored that VC firms Thrive Capital and Founders Fund have tendered an offer to buy employee shares of the company for a total of $300 Million. Given the recent tsunami of AI content and Social Media attention, it's unsurprising that the company developing the groundbreaking ChatGPT is coming in at such a high valuation.

AI comes to Mental Health Support

Another industry falls to the ChatGPT revolution, this time it's psychological support. The development was announced in a Twitter thread by Rob Morris, one of the co-founders of Koko, an operator of 24/7 Peer Support and self help tools. He announced that they had provided "Mental Health Support to 4000 people using GPT-3". This news quickly sparked a storm of ethical concerns, until it was clarified that those reaching out for support were not interfacing directly with ChatGPT, but instead with a human using suggestions from the AI to help "Craft their responses". In my opinion, this is one of those situations that is equal parts fascinating and terrifying. It's yet another signal that we're firmly on the path of no longer being able to be sure there is a person on the other side of the screen. Now what happens when they put that in a robot...

I wonder what it's so happy about?

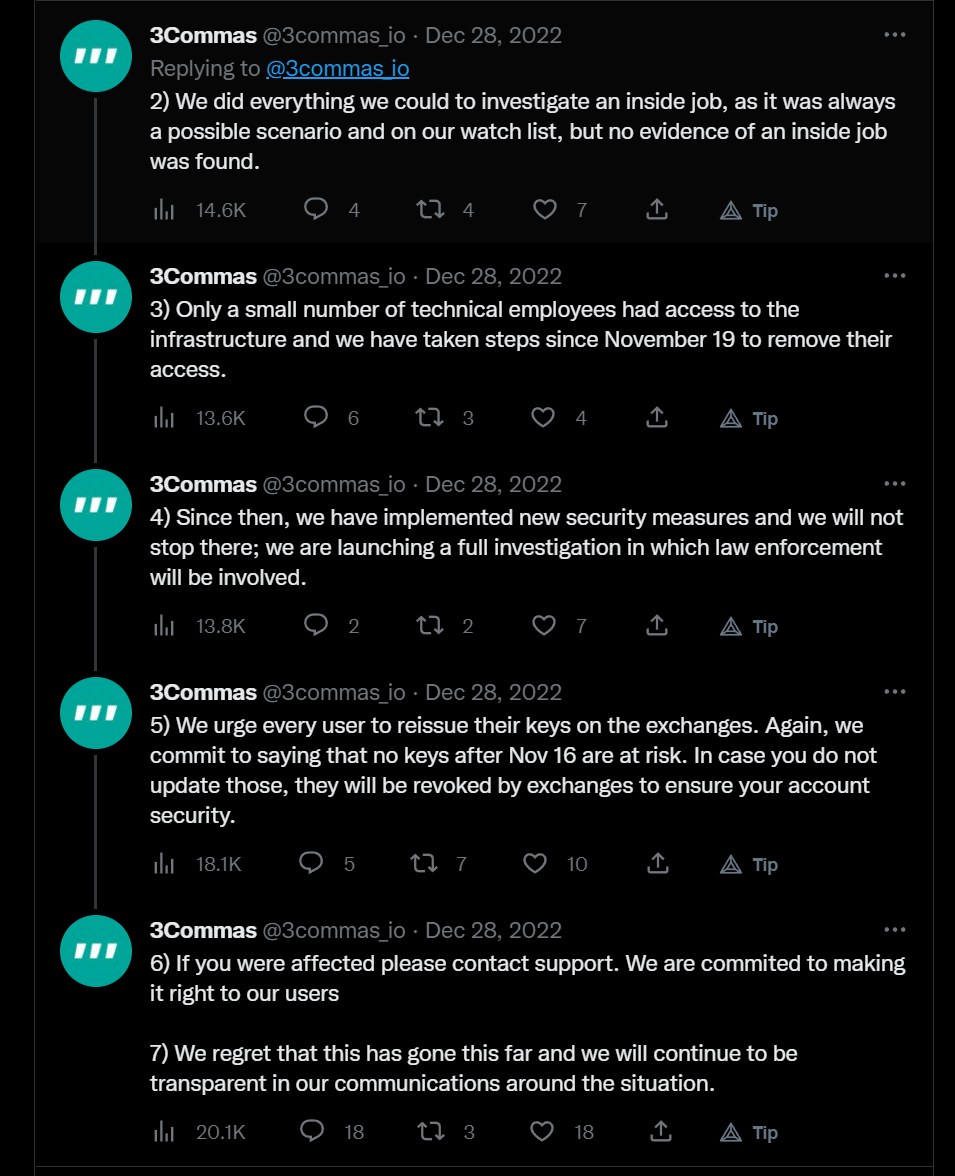

3Commas

The "Not your Keys, not your Coins" trend continues.

3Commas, a popular automated trading platform, recently confirmed suspicious that their API key database had been breached. Users Centralized Exchange account API keys had been used to trade on their accounts, bidding up the value of illiquid shitcoins that the hackers then dumped for profit. Unconfirmed losses are rumored to be in the millions, if replies to their twitter account are to be believed.

The real kick in the teeth? 3Commas has been denying these accusations for months. Now they have to enter the "rebuild trust" phase of the business plan, before they lose their customer base to Pluto.fi or Cyptohopper.

Since announcing the API leak, they've wiped their API database, performed a "security audit", and prompted all users to generate new keys. Now we wait to see if their database is breached again 🤷♂️

Discord Community Roundup

We're going to be highlighting contributions from the Unofficial Composer Community Discord every week going forward. Some weeks a tool, some weeks a particularly compelling (but usually completely untested) symphony, depends what we feel like writing about!

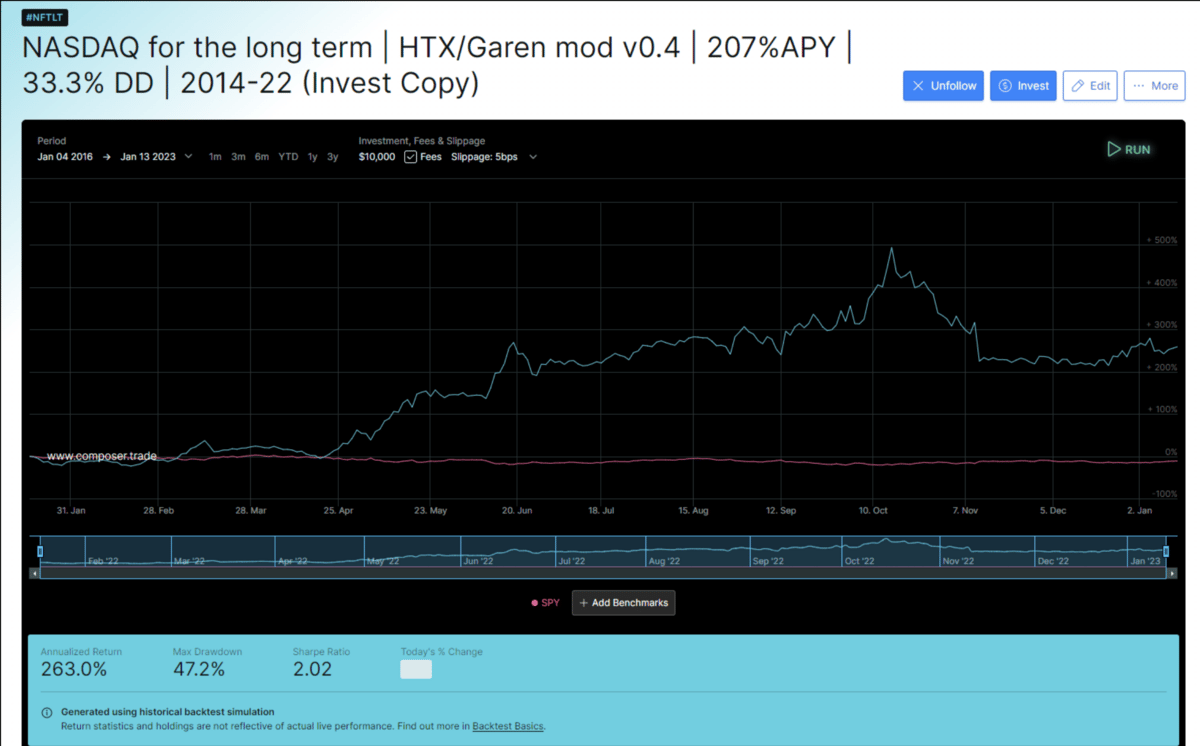

For the inaugural Spotlight, I'd like to show off one of the longest running community creations, one of the OG symphonies created by one of the OG creators, #Derek1776, NASDAQ For the Long Term!

The simplified rules are as follows:If Short Term RSI's on QLD and QQQ are overbought, go short.If Short Term RSI's and Cumulative Returns on TQQQ/QQQ are oversold, go long.If neither are true, go in to a basket of tech stocks.

An oversimplification for sure, but the proof is in the pudding as the kids say.

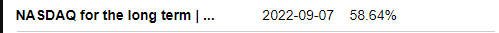

In this case, the pudding is a 58% return since 9/7/2022. QQQFTLT is one of the longest running, highest returning symphonies the community has come up with (that also has the most out of sample testing (fancy way of saying its been tested live).

That said, it's a High Risk, High Reward strategy, definitely not for the faint of heart. Sporting a Maximum Drawdown of almost 50% (my stomach hurts just typing that, ouch) this symphony would make most of the members of Wallstreet Bets think twice before YOLO'ing into it. However, if the last 3 months of live testing are indicative of anything (which they aren't, past performance isn't indicative of future results, you know this) maybe the risk is worth it if you've got the balls of steel to handle the potential downside.

Thats it for this weeks edition ladies and gentlemen, make sure to join the conversation over at the Discord Community.Good luck and happy trading!

Please note that the information provided is for general informational purposes only and is not intended to be financial advice. The information provided is not a substitute for professional advice and should not be relied upon as such. Always consult a financial advisor before making any financial decisions. Additionally, The Hard Road staff and contributors may have a stake in the Securities, Cryptocurrencies, Platforms, and other assets that are mentioned in this article and others.