Hello There

I like Bitcoin. Do you like Bitcoin? I hope you do, because today, I’m gonna tell you about Bitcoin and one of the most predictable trades out there.

There is a cycle to Bitcoin, a Bull/Bear cycle that isnt related to anything else going on in the world. And its got a pretty sweet name too.

The Halvening

I’m going to skip the explainer of what a blockchain is, why PoW mining is a good thing actually, and a lot of the entry level info about Bitcoin, in the interest of maximizing useful info. If you are interested in that, leave a comment down below and I’ll see what I can cook up for you. And full credit for this idea goes to Deez#3021, one of the OG Discord members, and the most degenerate motherfucker I’ve met in a long time.

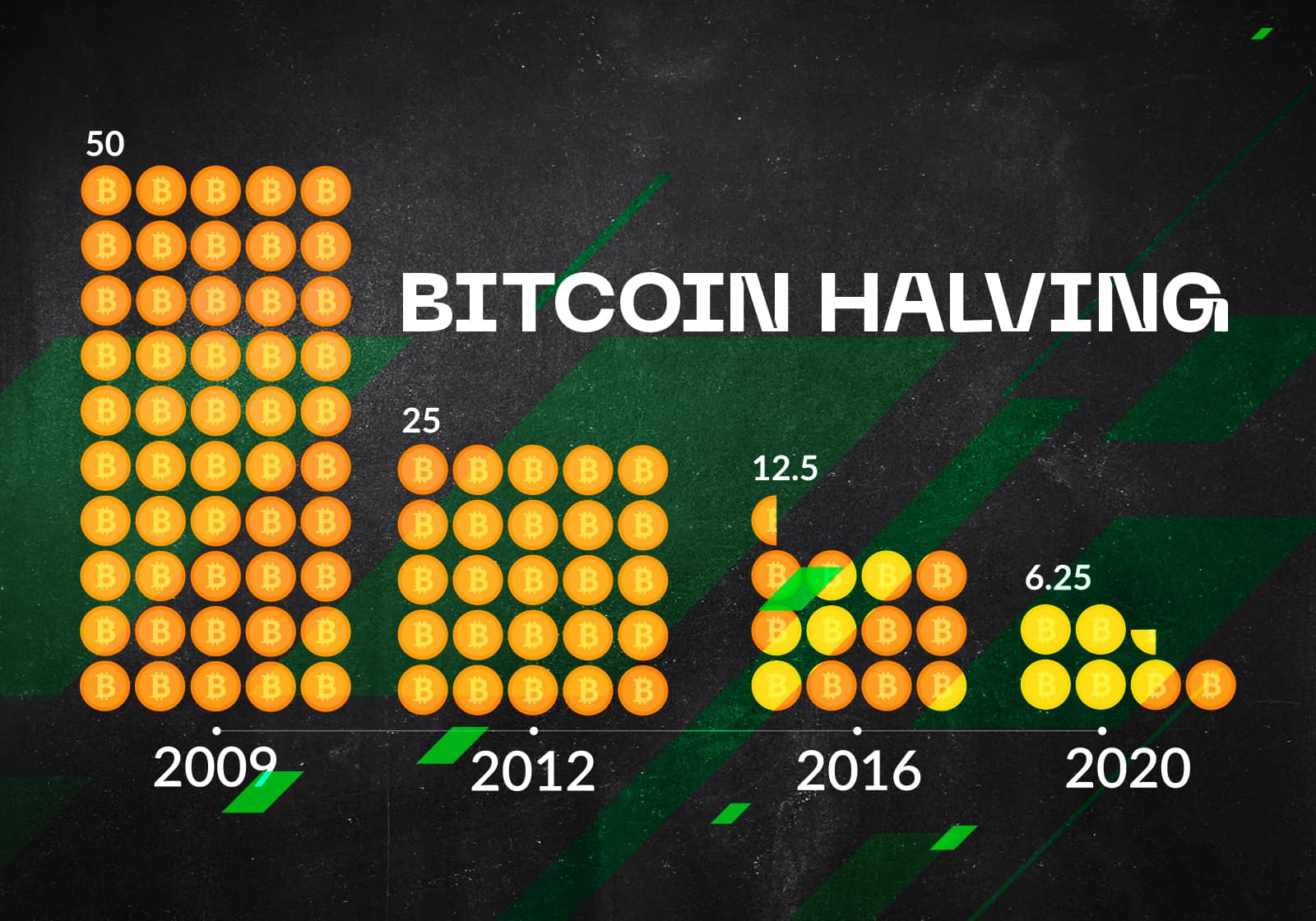

Every 4 years, or 210,000 blocks, the block reward (the number of BTC created with each block) is cut in half. Historically, this has triggered an interesting series of events, mostly appearing to work off of supply and demand. Less coins being introduced to the market, the more people will pay for existing coins. Very simple, yes?

If you’d like a historic overview of the past halving events, check out this article on StormGain!

As the CNBC article above suggests, the year before, and roughly 1.5 years after, a halving event are very big years for BTC. This timeline reasonably accurately predicts the tops and bottoms of the bull markets in BTC that have historically returned thousands of percent gains. And here is the “magic formula.” You ready?

The magic, in all its glory

There we have it, predictions and projections of the price action of Bitcoin until November of 2025. If you’re a non-visual learner, here are the steps written out.

Dollar Cost Average into Bitcoin until April 2024.

Wait until November 2025.

Sell.

Dollar cost average in again starting November 2026.

It almost seems too simple to actually be true, which is exactly why this isn’t financial advice, but is exactly why I’m going to be following this plan. For all of the “financial violence” of BTC, when you start drawing lines at specific dates, patterns start to become very clear.

Some will maintain that “Technical Analysis is just Astrology for Men.” And they may be right when you’re trying to draw fibonacci retracement levels on a 5 minute chart with a thousand different support and resistance levels, but when you zoom out the noise begins to fade away. Like the rotation of seasons, some general trends seem to always happen. Some winters may be colder than others, but winter always comes regardless. Shout out to Ned Stark.

That sums it up for this week. What do you think?

Am I a crackhead astrologist? Am I absolutely right? Set a reminder to check the chart above in 2.5 years, and let me know. If I’m wrong, I’m losing money with you. If it hits, don’t forget to pay the plugs. Drop a comment at the bottom if you want to tell me how stupid i’m being, or come berate me in Discord!

Please note that the information provided is for general informational purposes only and is not intended to be financial advice. The information provided is not a substitute for professional advice and should not be relied upon as such. Always consult a financial advisor before making any financial decisions. Additionally, The Hard Road staff and contributors may have a stake in the Securities, Cryptocurrencies, Platforms, and other assets that are mentioned in this article and others.

We’re getting back to Community Meetings!

After a long, busy couple of months, we’re going to be getting back to scheduling our weekend meetings! First up is our Coders Collab series, come check out what others have been working on and share anything you think is exciting for your fellow Community Members! Details can be found in the Events section of the Discord server, see you there!

Looking for a deeper dive?

Check out our in-depth course, or 1 on 1 coaching!

bc1qj86jlq4uc3hcp7nu33u09zg3lj8dclp7arnmj0

1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa