Ahoy Sailor

I’ve been reading, watching, and generally absorbing a lot of the thoughts of Ray Dalio. I’ve also been working on the next addition to the Battleship Family. Lets discuss how I ended up mixing those two together.

So what did I do?

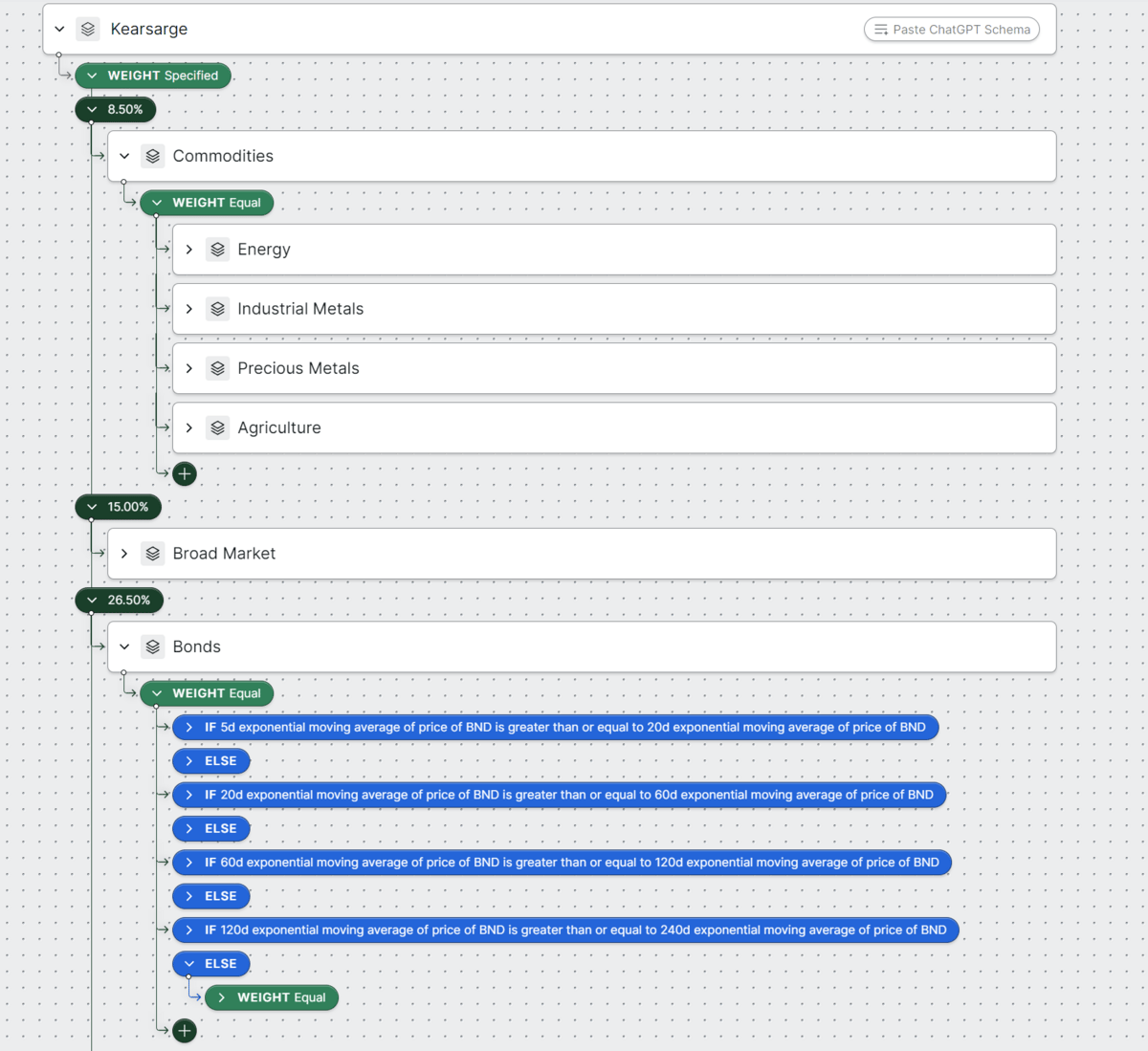

Well, I made this.

As stated above, I’ve been reading and watching a lot of Dalio content recently. Not all of it has made its way in to this strategy yet, but think of this as a continuation of my newsletter all about my problems with Battleship III. Strategy design is an iterative process, and this is another iteration towards my ideal.

An Overview.

So, the bones of this is pretty simple. I wanted to mix anti-beta strategies that are independent of any market with broad, trend following allocations. I find a lot of use in the adage of “Time in the market beats timing the market.” It may be true, but its incredibly boring. So, how do we spice up something like Dalio’s classic All Weather Portfolio in a new way? Lets go over some of the specifics.

Side 1 - Trend Following.

Very, very easy to grasp despite being visually large. The first 3 sections are weighted to a total of 50% of the symphony, and are broken down in to sectors and industries. In each sector and industry, there is a check to see if a shorter-length Exponential Moving Average is over a longer one, signaling a potential bullish market environment for that asset class over that timeframe. Beneath each of those checks is a dip-buying check filled with relevant high-volume tickers, using leverage whenever possible. The lowest Cumulative Return ETF (I specifically avoided ETN’s due to the risk of, you know, companies blowing up) is bought out of that group. When outside of a bullish context, some kind of index fund or similar is allocated to.

This process repeats within all the different industries, sectors, and indexes chosen to represent the classes deemed important to the All Weather Portfolio. Let me know if you think I missed anything, I almost certainly did.

Side 2 - Anti-Beta

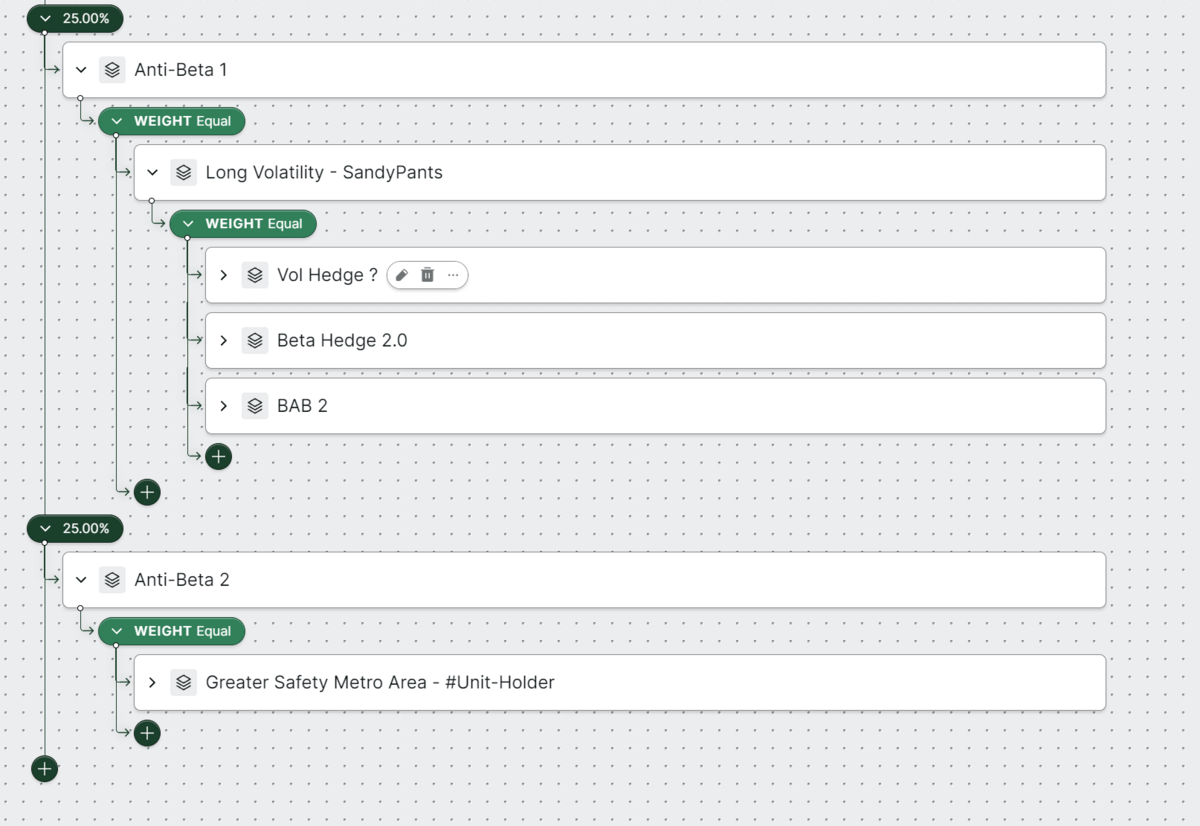

This is the side I can’t take credit for, this is the work of two brilliant community members crammed into one symphony. Utilizing the Long Volatility section from one of Sandypants#7720’s Dragon Variants and the collection of Safety Town symphonies released by Unit Holder over on Discord, we’ve successfully allocated roughly half the symphony to strategies that largely ignore the market. If you aren’t a fan of Bonds and Volatility based assets, this part of the strategy is not for you.

Outro

I could write a whole newsletter on each piece in this section, but in a very, very brief overview we’ve got several logic checks at the top of several branches that dip buy large drawdowns in major indices, and then utilizing a series of mostly RSI checks on volatility indices allocate to a basket of low-to-zero beta (in relation to SPY) assets like gold, short term bonds, and volatility ETFs themselves. It’s very, very dense and hard to really grasp at a quick glance but I absolutely love them.

So, thats Kearsarge.

History nerds may catch how I decided upon this name without breaking my need for continuity, but I digress, there’s the strategy. Same idea as last time, hit me up on Discord with all your criticism, changes, and general issues with the strategy. I think I managed to successfully hold to the “All Weather” nature of Dalios work while making it significantly more fun, and likely better performing too! Make sure to show Sandy and Unit Holder the appropriate love for the only parts of this strategy that have been live tested, as my work is completely fresh and untested yet. They’re the real heroes of this edition.

In the news

Please note that the information provided is for general informational purposes only and is not intended to be financial advice. The information provided is not a substitute for professional advice and should not be relied upon as such. Always consult a financial advisor before making any financial decisions. Additionally, The Hard Road staff and contributors may have a stake in the Securities, Cryptocurrencies, Platforms, and other assets that are mentioned in this article and others.