Welcome to March’s Report!

We’re going to take this nice and slow, plenty of foreplay before getting to the data.

Im going to be taking a different path with this going forward. Rather than the top/bottom 5, which feedback has shown to be unhelpful and counterproductive to what is being looked for. Instead, I'll be using the data we collect and gather to inform the creation of 3 different “portfolios” tailored to different risk profiles. The monthly updates will be reports on those specific portfolios, still accompanied by the ever-growing database of live strategies, as well as the database of strategies we’re evaluating for addition to the portfolio.

Thoughts on the direction? Opinions?

Love it?

Hate it?

Let me know!

As much as I enjoy writing about most anything, I enjoy providing useful information with my writing most of all!

So, lets start off with the “middle” of the pack in terms of aggression.

IC The Hawk and The Serpent

The first portfolio I’m creating is an homage to Artemis Capital Management, Harry Browne, and Mutiny Capital. Outside of “well known names, these 3 groups and individuals constitute some of my favorite writers and researchers on portfolio design, macroeconomics, and investing principles in general.

Chris Cole and Artemis Capital have written some of my favorite pieces on Volatility as a trade, as well as portfolio construction and macroeconomic trends. Two personal favorites being “Dennis Rodman, and the art of portfolio optimization” and “Moneyball for Modern Portfolio Theory”. Keep in mind, both were written well before Covid, and the associated effects on the stock market. Specifics they endorse are not necessarily the correct answers, but the overall.

A TLDR of each from chatGPT

The document from Artemis Capital Management LP titled "Dennis Rodman and the Art of Portfolio Optimization" draws an intriguing parallel between the unconventional basketball career of Dennis Rodman and modern portfolio management strategies in volatile financial markets. It critiques Modern Portfolio Theory (MPT) by arguing that traditional diversification, which failed during the 2008 financial crisis, needs reevaluation in today’s economic environment characterized by negative interest rates and aggressive central bank policies. Rodman, known for his vibrant personality and non-traditional playing style, exemplifies an effective but often undervalued asset. Despite his low scoring average, Rodman’s exceptional rebounding and defensive skills significantly enhanced his teams' performance, making him a crucial player in winning multiple championships. This sports analogy extends to financial strategies, suggesting that just as Rodman’s unique skills were critical during key game moments, investments in volatility can protect and potentially enhance a portfolio during market downturns. The document introduces "Rodman’s Paradox," illustrating how integrating seemingly underperforming assets, like long volatility strategies, can lead to greater overall portfolio efficiency and performance. It advocates for including defensive and non-correlated assets to improve risk-adjusted returns, particularly as markets face potential shifts, paralleling the underappreciation of defensive strategies in both basketball and investing.

The document "Moneyball for Modern Portfolio Theory" by Artemis Capital Management critiques the prevalent use of the Sharpe Ratio in investment decisions, highlighting its limitations and proposing a new approach for evaluating investment performance. The Sharpe Ratio, often used to measure risk-adjusted returns, fails to consider crucial factors such as correlations, skew, and liquidity. This oversight can lead to misleading assessments of portfolio robustness, particularly during market downturns, as the Sharpe Ratio does not account for how individual investments interact within a portfolio.

In response, the document introduces a more holistic metric, Cole Wins Above Replacement Portfolio (CWARP), which evaluates the true contribution of an investment to a portfolio’s overall performance, including aspects like return, risk, and drawdowns. This metric is inspired by "wins above replacement" from sports analytics, emphasizing the importance of contributions to team success over individual performance statistics.

Artemis argues for a shift in investment strategy evaluation, from focusing on individual asset performance as measured by traditional metrics like the Sharpe Ratio, to assessing how well an asset enhances the overall portfolio. This approach advocates for a more nuanced portfolio management strategy that prioritizes collective resilience and effectiveness over standalone investment merits.

The document suggests that the investment industry's reliance on outdated metrics can lead to sub-optimal portfolio constructions, advocating instead for modern metrics that reflect a comprehensive view of investment impact and promote more robust portfolio construction.

These two papers have heavily influenced the way I build “strategies” to be reasonably complete portfolios, or to fit a highly specific role, and excel at that role as best as possible. The end goal, in my opinion, should be to build yourself a maximally resource (money) efficient team of Dennis Rodmans. Spend as few resources as possible, but make sure that each of those resources contributes exactly what is needed at any given moment.

With the above information in mind, the following paper comes to mind on how to go about allocating your capital to achieve those goals across any and all market conditions.

The key takeaway is the classification and breakdown of market regimes and cycles. Growth, Decline, Inflation, and Deflation.

A bit of cursory thinking will give you a general idea of what does well in these scenarios, but Mutiny Funds has done the work of saving us from thinking by providing us a lovely infographic.

For MPT historians, or just market nerds, you may recognize the name “Permanent Portfolio.” Coined by Harry Browne, the original portfolio seeks to maintain its ability to go up, or at least stay flat in basically all market conditions by investing in long term bonds, short term bonds, equities, and gold. Thoeretically, something that will go up in all situations. It’s all well and good, results in a CAGR of roughly 7% according to Mutiny Funds research and number. Not bad, but we can surely do better with the technology available to us, wouldn’t you agree? Sure, there will be concessions in terms of maximum drawdown, but personally that is a trade I’m willing to make! I’ll take a 20% DD with an AR over 40% any day of the week.

With all the above in mind, lets get on to the actual construction!

Some notes on the portfolio creation

As I’ve explained in previous reports, we’ve established a set of criteria which we screen the various databases for in order to be included. Exceptions can be made in the case of needing to test a specific bit of logic, or just having a wacky idea to test out. As I’ve said before, Garens portfolio composition theory is wildly different than mine, and resembles a shotgun shooting birdshot more so than a precision rifle.

The “portfolios” I’ll be showing off today are going to be “master symphonies”, as the community calls them. This will be a process in which I’lll be putting together my portfolio based off the testing we’ve done so far with the database of strategies, with a few additions I’ve been watching out of sample for quite some time. Now, I will be running these within the broader portfolio, mostly for demonstration purposes

Now, onto the process

On a risk adjusted basis, the strategies are, somehow, almost dead-even on a calmar-to-calmar scale. That is perplexing, but when you take in to account the changes in drawdown and AR, it begins to make sense. The sorters ability to avoid drawdowns is better than the static allocation, as you can always just rotate in to BIL on the rare occasion everything is going down. You do lose out on some gains you could potentially have with an allocation to all possible strategies. Spreading it between all the strategies ensures you’re always in something that is going up. On the other hand, if the rare occasion that all the strategies are going down over a period of time, there isn’t an “escape route.”

In the words of Thomas Sowell, “There are no solutions, only tradeoffs.” Time will tell which strategy will win out, however I suspect it will come down to personal preference, and how much you trust sort functions.

Equity Assets

This section will obviously be the meat and potatoes of the returns for the strategy. Most everything else exists to lower any potential drawdowns and to help out in times that are just really, really bad for the major market drivers of the age. That said, it requires you expect the dominance and outperformance of US markets

Similar to the indexes we all know and love, SPY and QQQ, the strategies are very tech heavy. I don’t think any reasonable person would say that the Big Tech companies are not going to be the driving factors of most parts of the US economy for the foreseeable future. That said, in a world that may come to pass where this is not the case, many of the strategies are simply trading indexes and have plenty of offramps to things like GLD, Consumer Staples, and various bond and managed future funds.

As you can see from the above correlation plot, over the length of the (relatively short) backtest we’ve got less than a .5 mean correlation, which means that when X moves, Y moves in the same direction at a percentage rate equal to the number given multiplied by 100. So for example, TQQQ FTLT and Risk on/Risk off have a correlation of .162. This means that, statistically speaking, 16.2% of the time that TQQQ is moving up (or down!) Ro/Ro will be moving in the same direction. Its a great example of how you can invest in nothing but the most broad and generic indexes and markets, and still hedge risk in a lot of situations by diversifying logic.

If you go to https://mymaestro.co/ and isolate the blocks above, you can see a detailed graph of the correlation over time, and you’ll see that the mean correlation fluctuates between 80% and 20%. Not the most consistent, but it is heartening to see that (with the exception of black swan events like the March 2020 Covid Crash,

Above, you’ll see the same correlation chart, but specifically for drawdowns! Making sure that your strategies don’t all move in the same direction during a bear market is key for thriving (or even just surviving!) a year like 2022.

Commodities

The next piece of the puzzle in constructing our Permanent Portfolio is Commodities. Now, this commodities section isn’t as expansive and all inclusive as the Mutiny Funds Cockroach would like, but it is substantially more diverse than the simple gold allocation called for by the Permanent Portfolio. My reasoning here is that we have several well-tested and reasonably robust index wide commodity strategies, as well as several energy-specific strategies.

As you see, while there is relevant correlation between the energy strategies and the broad-index strategies, there is almost no correlation between these strategies and Gold.

The same holds true for the drawdowns. Almost no correlation between gold and the rest of the strategies, but a relevant (but not significant) correlation between energy and broad-index strategies.

Now, the above image might be hard to read on mobile, so I apologize, but I think it is quite important to show what the lack of drawdown correlation in gold looks like, and its affect on returns over the period. Broadly speaking, this block is almost entirely trend following, with a couple mean reversions thrown in, with no individual companies to speak of. As far as longevity of a strategy goes, the idea that a 50/200DMA crossover stops being indicative of a trend seems quite unlikely, but technically possible I suppose.

Bond Focus

Three unique momentum checks, 2 different rate rising/falling checks, and the full spectrum of Bond Market timeframes make this a simple, yet incredibly robust block on its own.

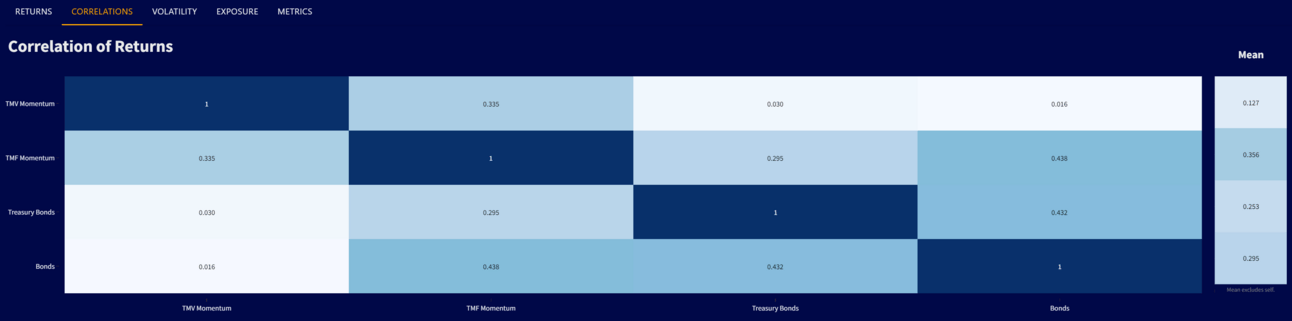

Despite trading what amounts to ~6 separate assets, (short, medium, and long duration bonds with a splash of cash and defensive assets) we’ve managed to achieve a selection with extremely low correlation, meaning that the movement of one does not predict the movement of another very often.

Volatility Focus

This is possibly my favorite image in this entire article. The volatility blocks have almost no correlation to each other when they’re collectively in a state of drawdown. In many ways, this block acts as the black swan catcher of the entire strategy, just as Mutiny Funds and Artemis describe the volatility trade, with inspiration from . It is a hedge against any rapid and unexpected shifts in the market, as any good volatility trade should be.

Now that we’ve got out individual sections laid out, lets look at the blocks play off eachother in aggregate shall we?

In Aggregate

With an average mean correlation in drawdown of .132, we have an astonishingly low correlation between our blocks. Now, as referenced in the papers up above, this was exactly the goal. A strategy that will not set the community on fire, but if it’s performance keeps up it is certainly more than enough to put the average wealth managers performance to shame!

Now, I’m roughly 2000 words in, and quite frankly I’d like to refine the next strategy a bit more. You may be wondering to yourself, “this is cool and all, but this is still way out of my risk tolerance. What have you got that actually seems like a reasonable portfolio?”

Well, the next step is re-creating the Cockroach Portfolio by Mutiny Funds. A strategy that specializes in gaining less than 10% a year on average but rarely if ever having a deeper drawdown than ~15%