Welcome welcome, to the first Investors Collaborative Premium Report

Here is it, as promised.

(If you read the initial teaser, this top part will seem very familiar)

Lets hit some quick notes about what exactly we’ll be covering in these reports, since I’ll be sending this report out to the general public and not just existing Premium subscribers.

Total Return of the portfolio.

New Symphonies added to the portfolio, and why they were added.

Symphonies removed from the portfolio, and why they were removed.

Top 5 and Bottom 5 strategies of the month, and detailed breakdowns of each.

What part of the strategy is activating? We’re still expanding our branch analysis capabilities, so these are relatively general currently. I’ll be working on these to add detail for future reports.

Are the statistics still within historic boundaries of expectation? Put simply, has it broken yet?

QuantStats report of each strategy for the previous month.

A 100,000 foot view of what the general goal of the strategy is supposed to be. If I’ve done an associated deep-dive in our free tier newsletter, I’ll do my best to link it. Additionally, if Garen has a YouTube video pertinent to the strategy, an interview with the creator for example, I’ll embed it in the appropriate section.

We’ve got a grand total of 95 strategies currently in the tracking pool, with data going as far back as 08/09/2022 and starts as recent as mid October 2023. Now, there have been changes in when Composer executes orders in that time, so there are limits to the absolute accuracy a lot of older data. However, I believe that some data, even if imperfect, is better than total mystery.

So how does something get included in the portfolio?

As of right now, the criteria is very, very loose. The way we see it, we’re currently in the “testing and proofing phase” of Composer, and decentralized algorithmic design in general. Given the extreme experimental status of the platform when we started this process, a large number of these strategies are here purely for science, and proofing out theories that we’ve had at some point or another.

As we go, I will be pointing out strategies that we generally consider stable and ones that are markedly outside of something we’d ever recommend actual investment in to. Not recommendations or certification, but a general sense of how accurately we feel the strategy is sticking to its “plan” so to speak.

We will be adding to this portfolio periodically. We do not currently have a schedule for when, but the number of new strategies we follow will likely be directly correlated to how popular these reports end up being!

Also, the 4 custom strategies from our Genesis Portfolio are going to be included in this report. I’ll provide links to them below the paywall.

As far as other unique strategies, we’ve made improvements to several other community strategies to remove low volume and delisted tickers. I don’t necessarily count these as selling points though, because given enough time and dedication you could completely replicate them.

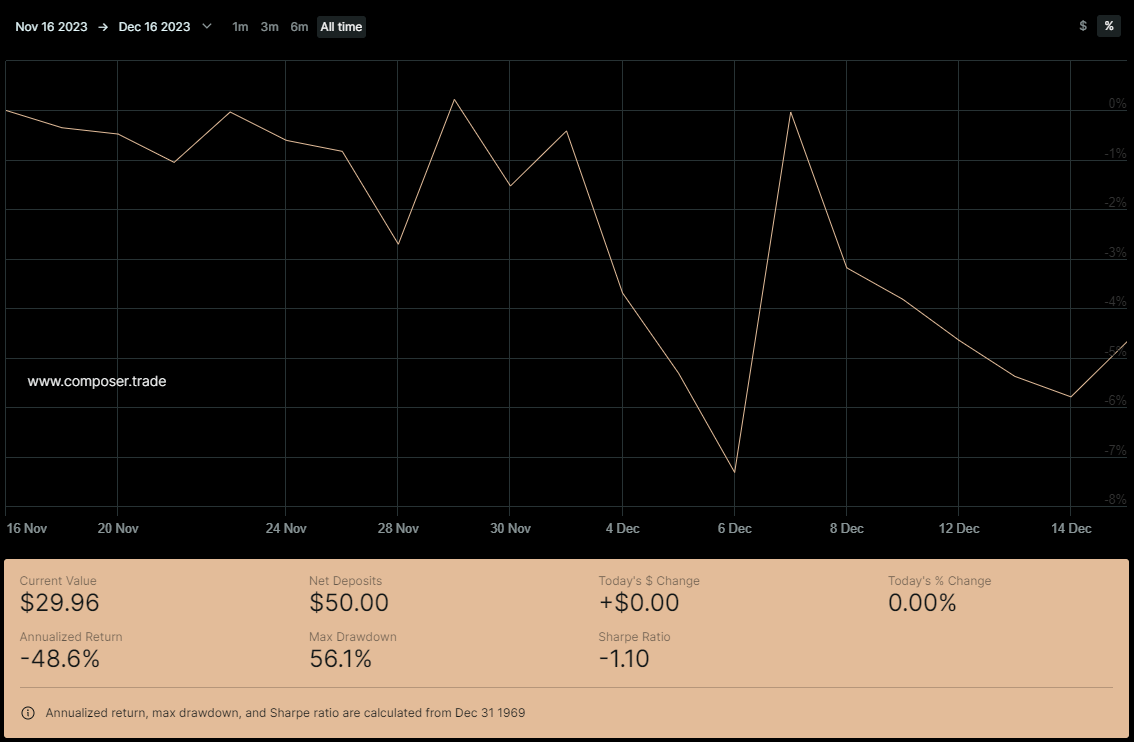

Now, as a bit of a teaser, here’s the Composer Screenshot with the start dates and current values of everything.

Alright, got all that? Good!

We are running a 50% launch special till January 14, 2023. Here’s the link to get access to our full dataset.

A couple notes, the 5 custom strategies from our Genesis Portfolio are going to be included in this report. I’ll provide links to them now.

What are we watching, and how is it doing?

Strategy Database Link 🔗

click 👇

It is password protected! The password will be rotating monthly, and the new password will be sent out with each months report. Sorry, no free permanent access boys and girls.

All the way at the bottom, you’ll find the attached list of pre-generated quantstats reports.

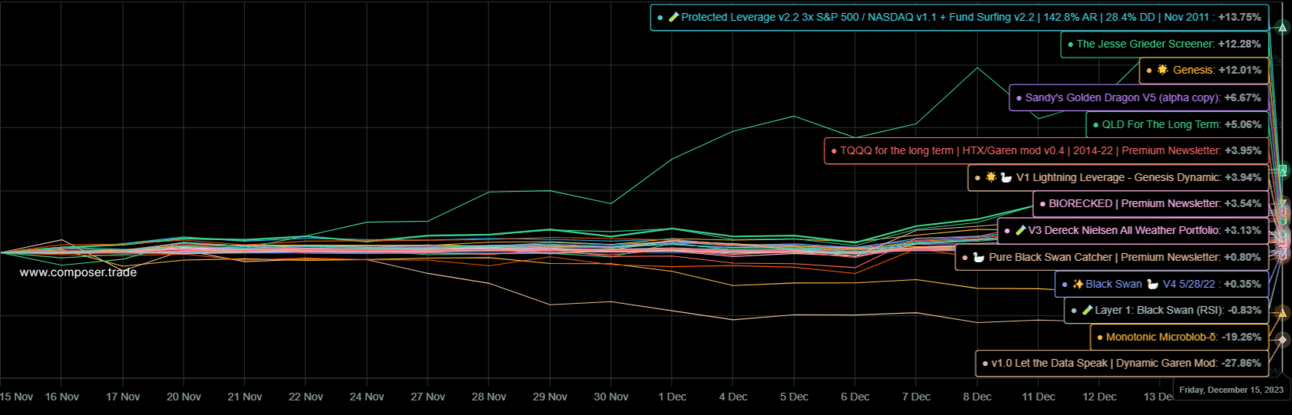

The Previous Month’s performance.

Portfolio 2

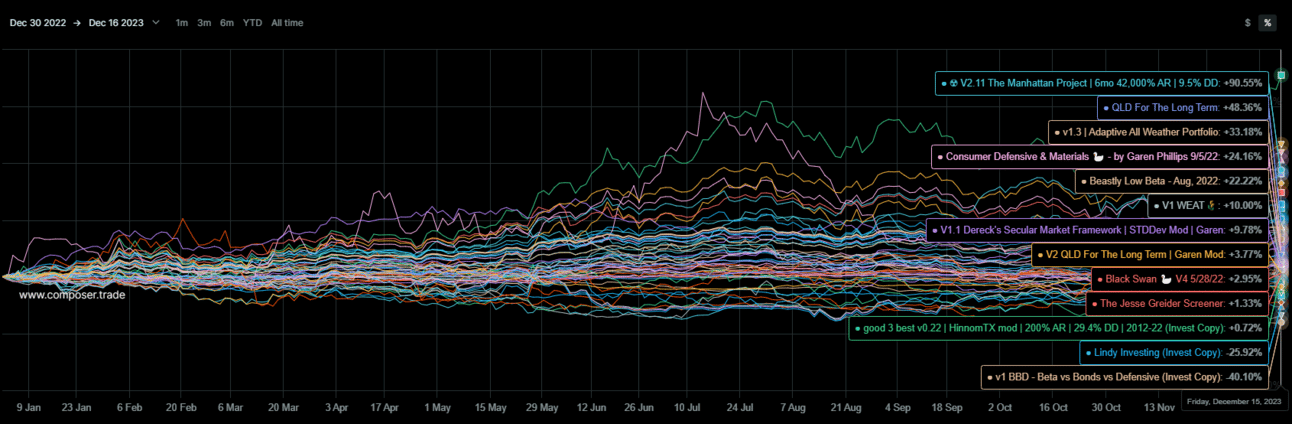

An all-time chart, for posterities sake.

Portfolio 2

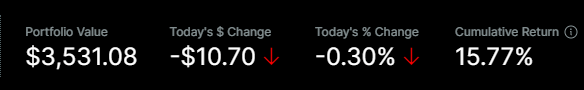

Cumulative Returns as of 12/20/2023

Explanation of top 5 Strategies

Good 3 Best v 0.22 - 21.21%

This strategy had a really, really good month, but is roughly the 3rd worst performing strategy in the portfolio. Unprofessional opinion as to why will be held off until the branch activation analysis is fully online, but this is up for further research near the top of the list.

Branch 24 only triggered once in the last month.

That put us squarely 100% UVXY on the run up the day after the Fed more or less announced no more rate hikes. Besides that, we’ve been in an equal weight basket of SOXL, TQQQ TECL, and TMF. Solid time to be in those!

Broadly speaking, this strategy intends to blend mean reversion with trend following, using the broad market moves to inform what kind of baskets the strategy buys from. Depending on conditions in the Equities and Commodities markets, baskets range from exclusively leveraged equities, to entirely market neutral and low-beta assets like Emerging Markets, commodities, and Coca Cola.

Protected Leverage v2.2 - 13.75%

On a high-level overview, this strategy is relatively simple. Using a check of the overall Bond Market, via BND being above or below $0 Cumulative Returns. depending on the status of the bond market, the assets are selected by either dip buying leveraged assets selected a few more defining checks. Additionally when everything is stacked against you, the strategy has the option to end up equally weighted in a basket of things that are uncorrelated to the overall market like oil, gold, and beta-neutral ETF’s. This strategy thus far has been incredibly market neutral, with a beta of -0.1

We spent most of the month in the topmost basket, and on the day of the Fed’s announcement about rate hikes no longer being projects, we were in a combo of $TMF, $PDBC, $BTAL, and $UMDD resulting in a bump of about ~10% in about 4 days.

The Jesse Greider Screener - 13.66%

Simply put, value companies have been on an absolute tear recently. That’s almost all of what this strategy contains. It’s been dip buying like a champ over the last month, but as the overall market has been trending down, so has this strategy.

If you’d like a deeper dive on the criteria this basket was built with, check out Garens interview with Jesse Greider, a professional Private Equity investor.

There isn’t really any logic branches to be analyzing here, its just rotating holdings, but we’ve cycled through most of the possible holdings, except $LULU, $EXPD, $ASML, and $SMLR. Dip buys of profitable companies working their magic!

Consumer Defensive and Materials - 13.60%

We’ve actually got a ticker in this one that has prevented this from trading for a bit. The above link is fixed, and we should be trading again by Monday (whenever this ends up going out, it may be trading already) but I’ll refrain from much of a deep-dive until its back again.

Genesis - 12.01%

One of the custom strategies made it!

A high level overview of this strategy is tough, as the Genesis Portfolio strategies were built to be reasonable approximations of a portfolio in their own right. They should, and thus far are, performing reasonably well in most market conditions. Genesis is outperforming SPY, at the very least.

Explanation of Bottom 5 Strategies

v1.0 let the Data Speak - -27.86%

As a general thesis, this strategy consists of 3 sub-strategies selected by the highest standard deviation of returns over the last 30 days. This is all well and good when the strategies are trending up, but the obvious issue there is that Standard Deviation just cares about how much the strategy is moving, not what direction. As a result, this strategy can and will grab strategies that are absolutely drilling to the center of the earth. but conversely it can grab strategies that’ll net you 200% a year. The jury is still out, we’ve only been live testing this one for about a month.

Monotonic Microblob o - -19.26%

We managed to break the branch analysis tool with this strategy. Hopefully I’ll have a deeper explanation of its downtrend for the next repor

, but a high level overview of how its supposed to function is that it aims to capture any upward trend in the market by selecting the most beaten down strategy in hopes that it rebounds.

Part of the reason we’ve included this strategy in the portfolio is that we want to test if selecting downtrending strategies is a viable option. The backtests say that it is, however live data is far more compelling that backtests. Time will tell.

Lindy Investing - -5.09%

As a value investment rotator, Lindy is not faring too well in a “fuck value, pile in growth” environment. It’s day will likely come one day, but who knows how long it’ll be til that happens. Rough couple weeks post-FOMC meeting for sure. Holdings this month were $PFE, $PG, and $JNJ.

v1 BBD - -4.68%

Generally bad month. If you check the overall for this one, its one of the lowest performing members of the portfolio, and at this point is so far outside its historic bounds I’m putting it as first up for removal from the portfolio. its a bad sign when the drawdown that started very soon after your OOS date is the longest and deepest drawdown its suffered…..

Layer 1: Black Swan (RSI) - -0.83%

As one of the simplest strategies in the portfolio, this portfolio exists for one purpose. To sit in Gold and $UUP (a dollar-bullish forex basket in ETF form), until the S&P500 becomes massively overbought in a bull market, at which time it begins shorting the S&P500.

We want to test the viability of many of the most popular black swan catchers the community has created. This one happened to be on the wrong side of the Fed meeting, and continues to be wrong, driving its solid month down to barely down over the last week or so. Does that mean the concept is wrong? No, but the concept needs to prove itself out.

Thats going to conclude the first Investors Collaborative Premium Report!

Looks like we can sum December up with one statement. The top strategies handled the FOMC meeting well, the bottom strategies didn’t!

Feel free to leave a comment below, or message Jake or Garen over on the Discord Server with any thoughts, comments, things you’d like to see, things you don’t care about, any suggestions you have!