GM, this is the Hard Road Newsletter. Lets get it.

Our Analysis

Here's a chart of the SPY.

Yellow line is the 200 SMA.White Line is the 20 SMA.Bottom indicator is the 20D Cumulative Returns

For those that don't know, Pivot Points, are reversal points of trend channels. You can see the trend marked out using a Regression Channel drawing tool inside Trading View.

We are expecting a continuation of this next wave of the downtrend, at least 1-3 weeks.

The major resistance we are seeing is $350.Note the RED drawn line for primary prediction of a support bounce and Orange as a secondary breakdown.

20D Cumulative Returns (Bottom Indicator)Looks like we're in for a bumpy ride! The current trend channel hasn't even hit the $350 support mark yet and the 20D cumulative returns are barely scratching the surface of their typical bottom of -10%. Buckle up, because it looks like we've got more room to fall over the next 1-3 weeks.

Trend Continuation or Reversal ZoneIf the trend holds at the $350 level, we may see a change in the trend between Apr 03 and Sept 05. At this point, the market will either continue to decline or reverse into a bull rally. Alternatively, the current downward trend may continue if it falls below the $350 level.

Major Indicators to Watch

FED Interest rates and money supply constriction will be a major factor in determining the market's direction. An increase in rates could mean more bear markets on the horizon. In other words, if the FED raises rates, it's time to start hibernating like a bear

Unemployment Rate/Participation Rate - If layoffs increase, expect less money going into the markets.

Public Sentiment - The bear market may continue if your grandma, mom, and uncle who live paycheck to paycheck are starting to save money out of fear.

Check out the Interactive Trading View chart here.

Crypto Scams coming to light

Check out Coffeezilla's video!

6.7 Million views in just 2 weeks. It's worth the watch.

Bitcoin

@LukeDashjr, a well known BTC Core developer, has had hundreds of BTC stolen in a hack. Whatever your personal feelings on Bitcoin and Crypto in general, a Core Dev having their coins stolen doesn't promote confidence in the average person ever being able to muster the personal responsibility needed for mass adoption. Truly a wrench in the plans of anyone hoping for an Orange-Pilled Future.

https://twitter.com/LukeDashjr/status/1609613748364509184

Composer - Algorithmic Investing

A Letter to the ones who Build

We're organizing a letter to the engineers at Composer, asking questions about how they calculate Moving Averages, RSI numbers, and other questions best left to the experts. The CEO Ben Rollert has agreed to have his engineers answer user questions directly. Join us on the Discord Channel to contribute your thoughts and join the community!

How soon till SKYNET launches and become self aware?

Better question? Will there be a crypto coin we can invest in for the destruction of the world? Is it immoral to invest in the technology that could kill us all?

Most importantly, are robot girlfriends the future of the human race?

Let's Talk A.I.

Have you enjoyed our title cards? They were all created with DreamStudio.AI

If you don't know who Alex Hormozi is, you should.

He built a business from 0 to 100M in just 6 years. Now he does private equity investing through his business www.Acquisition.com

He just released a killer video on how A.I. is changing the face of this earth.

Here are a couple ways AI is going to impact the areas we focus on the most;

Trading: Using AI in trading can improve accuracy and speed in analyzing market data and making trades.

Risk assessment: By analyzing data and identifying patterns with AI, financial institutions can better assess and mitigate risks and prevent fraud.

Personalized financial advice: tailored to an individual's unique circumstances and goals, can be provided with the help of AI.

Credit Defaults: I've already talked with developers that have created AI to monitor social media behavior and provide early warnings to lenders of potential default.

Fraud Detection: AI can help detect unusual patterns of behavior that may indicate financial fraud, protecting customers and reducing losses for financial institutions.

Our Analysis

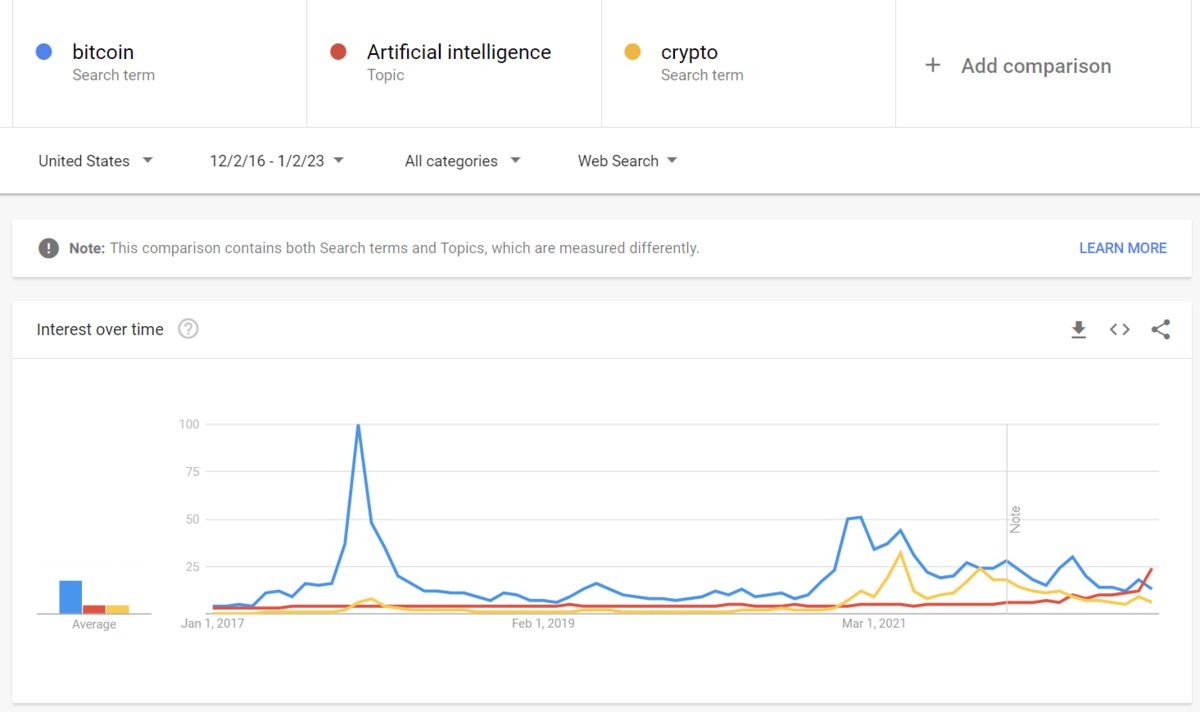

With the Crypto mania over and people looking for desperate gainers we might have the next mania wave come into AI. ChatGPT and AI has been hitting the news hard. Growth has been insane and google trends has hit hard as crypto in of 2021.

A quick look at Google Trends shows a very large uptick in searches for "Artificial Intelligence". It hasn't reached the popularity of "bitcoin" yet but it is almost up to par with 2021's search for "Crypto"

With that said, there's a few ETFs that focus on A.I. if you want to get in on the action. BOTZ & ROBO

That about covers the biggest news of the week, let us know what you think over on Twitter or in the Community Discord!