Happy Easter everyone! Hope your feast was delicious, your family healthy, and your portfolios green!

Now that we’ve apparently passed the point of everyone caring about banks collapsing, the Bulls have taken the market well above the 4000 mark, for seemingly no reason beyond “Nothing bad is happening, and the JPow is gonna have to pivot!” The $300 Billion of liquidity they pumped in about a month ago probably helped a little bit too, if we’re being honest.

Just like that, months of QT undone.

I’m not what you’d call a Bear, but this rally doesn’t seem to have any logical reason to be happening, for a couple reasons. Lets discuss.

Credit Crunch

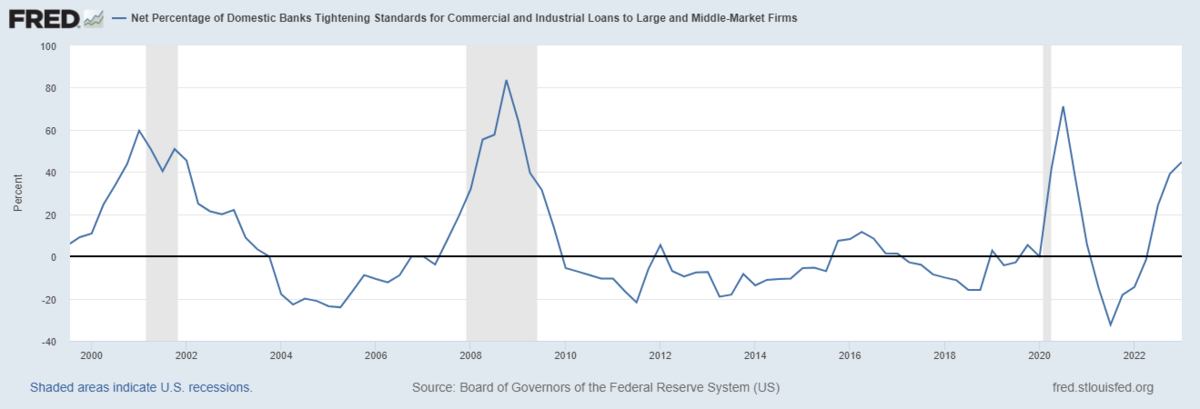

Logically, the next domino in the chain of crises is credit. You raise interest rates and tighten monetary policy, credit becomes more risky, lending requirements increase, lending becomes more scarce and expensive. We’re currently watching the “Credit becomes risky” domino tip into the next, wondering if it has the momentum to keep the chain going. Lets check out the word on the street.

The above thread has a couple graphs in it that paint a very detailed picture of the situation we’re currently in. Bank deposits are down and have been trending that way for months.

The less money banks have, the less they can lend.

The less they can lend, the harder they are to get.

The harder they are to get, the less businesses can grow.

And there we have it, loan volume is rapidly approaching the same levels as the beginning of Covid Lockdowns.

So thats what usually happens, interesting…

Not a pretty picture to be painting. Lets feed that confirmation bias with some more pretty graphs and anecdotes.

Commercial Real Estate?

Now that I’m well and truly uncertain of what comes next, lets look at what might be further down the chain. I mentioned this topic a few weeks ago in this newsletter linked below.

If you click no other link in this newsletter, please watch the below video!

The quick hits -

Biggest spike in Fed Discount Window borrowing since 2008

Banks can’t make new loans because they’re desperate for liquidity.

~$20 Trillion of CRE loans currently exist, ~$270 Billion are coming due for refinance in the coming months.

The average total assets of the banks holding these loans in ~$250 Billion each.

Unrealized losses on these CRE loans are not visible yet, because those markets are much more dynamic and less liquid meaning the assets have not been re-priced with changes in demand.

Want some more anecdotes? I got you.

Lets not assume that average joes like you and me are immune from these problems.

That’s gonna do it for this week!

We’ve got a big one ahead of us, lots of data coming this week. Stay safe out there!

Wanna come hang out in the bear cave with me? Join us over on Discord!

Please note that the information provided is for general informational purposes only and is not intended to be financial advice. The information provided is not a substitute for professional advice and should not be relied upon as such. Always consult a financial advisor before making any financial decisions. Additionally, The Hard Road staff and contributors may have a stake in the Securities, Cryptocurrencies, Platforms, and other assets that are mentioned in this article and others.