Its Showcase Time again.

All because sharing the best brings out the best.

It is yet again time for another community showcase. We’re coming up to wash-sale consideration time, so lots of people have been dumping their long-term data on some of their strategies. This showcase is going to be on a family of strategies, rather than one specific one because it seems like they’re all doing relatively well! Lets start with the one that got my attention first.

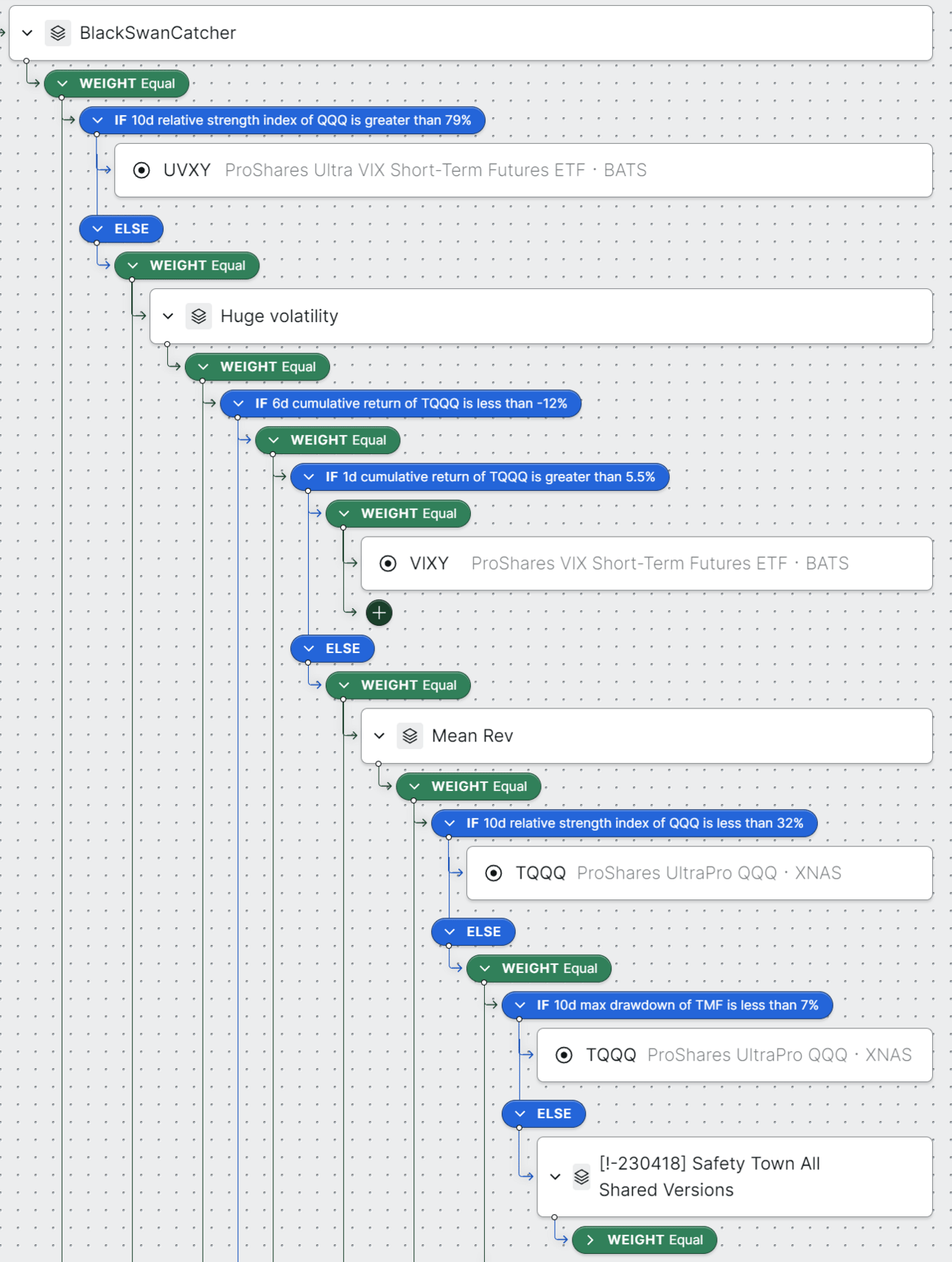

As an astute architect of strategies, you surely noticed that this looks very different than you’d expect, at least at the very top. This is actually two separate strategies in one, weighted to 100%/0% to avoid wash sales. Lets stick to analyzing the “TQQQ or Not” side.

So, we start off with a couple black swan/overbought/oversold checks. Solid logic. Mixed feelings about going all-in on volatility assets like UVXY, but we address this in a later version we’re discussing. All up to your personal risk tolerances.

Mean Reversions for days

So, if we’re not in a black swan period or huge volatility, are we in normal market conditions? Probably, so thats what we check next. Yes, i’m purposely ignoring the “Safety Town” blocks at the moment. They’re a trip in themselves.

So if TQQQ isn’t crashing, we make sure its not in a huge drawdown, same with 30 year bonds. If either is crashing, safety town. If not, and TQQQ is bullish? TQQQ. Simple enough. 2 safety checks, go long if we’re safe. I’m on board so far.

So, if we aren’t super volatile, QQQ isn’t crashing, or slow burning, or super bullish, we move on to checking the status of SPY. If the RSI of SPY is on the bullish side, we check bonds vs SPY and go long vs safe accordingly.

If its bearish, we check the yield curve. 30 Year bonds outperforming 7 year and bonds more bullish than SPY? Go long TQQQ. If the 7 is greater than the 30, safe.

It looks intimidating, but it’s a relatively simplistic strategy. A couple bond market and general market state checks. Nothing absurdly short term or overly sensitive. But, on to the data.

First impression, it beat SPY but 20% seems really unimpressive, no?

Well, thats because the original version is unleveraged. It beat the shit out of SPY without the benefit of leverage. Wild. A backtest of the version I linked above over the same time period looks something like this.

Just about triple the performance, as we could probably expect.

Check out the original post over on the Discord Community!

Remember how I said there was a bunch of potentially wild shit in this one?

Lets check it out without all of that.

I’m going to refrain from going over the logic again because its exactly the same, but the positions this one takes are much less risky. No more going all-in on leveraged volatility products that regularly move 10%+ in a single day. Does it cut in to gains? Sure. Does it make it much easier to sleep at night? 100%. Once IRA’s come, this is likely the version I’ll be running.

As you scroll through, you’ll see every instance of Safety Town, and all the volatility products, replaced with BIL.

Upsides? - You can backtest it all the way to 2010. It’s netted a respectable 72.6% backtest AR over that time, and you can actually sleep knowing you don’t have to deal with K1’s or UVXY.

Downsides? - Backtest says it’s 30% of the performance of the OG version. In order for this to be a downside, you need to trust that the strategy was built on solid thesis and not just pretty backtest lines. Up to you.

Jason Vouch link

https://discord.com/channels/1018958699991138386/1110749231347683368/1182893164953088011

Now, the OG that started it all.

The logic is more or less identical to the other two, with the allocations being something in between the “minimal risk” non-degen version and the “maximum fit” Safety Town version.

I don’t really have any additional commentary on the allocations. This seems like a decent mix as part of a balanced portfolio. Maybe running all 3 equally balanced against eachother, with something that won’t end up in in UVXY, VIXY, or SVXY? Thoughts and ideas. If you’ve got something that shows a lack of correlation to these 3, drop a comment below or a message over in the Discord Server!

Bonus Mini Breakdown - Safety Town.

So, the block in the V1.1 strategy all the way at the top contains a collection of a series of strategies that seek to be as neutral and uncorrelated to the overall market as possible, mainly through a balance of volatility investments. Generally you bounce around between short and medium term volatility futures ETF’s based off the condition of SPY. If you want me to do an in-depth breakdown, drop a comment below!

Thats gonna do it for this weeks showcase!

Check out the conversation around this family over on the Discord Server, and post up any combos or changes you think of!