Good Morning Hard Road, did you have a good weekend?

We had a busy, busy week last week hosting two separate informational calls. There’s a ton of info to unpack from them, so lets get to it!

First up, our call with NEOS Investments

I've actually got 2 calls to recap with you folks today! Our first call was with Garrett Paolella from NEOS Investments, a group who has been responsible in the past for creating QYLD before its acquisition by GlobalX, one of the most famous Covered Call ETF's in the world. NEOS created and manages 3 Income focused ETF's across a range of underlying assets such as the S&P500, Bonds, and Cash Equivalents. It was a very productive call, an in-depth Q&A session going over a full explanation of their funds.

A couple highlight of the major topics covered

How they quantitatively determine where to sell their calls, and how they maximize value generated.

What the team learned from QYLD and how to avoid capping the upside while suffering all the downside and equity loss.

Potential tax advantages of their system for the investor.

The overall risk exposure profiles of their products in relation to the underlying assets, as well as how these assets compare to the major institutional processes they replicate.

Discussion of the pros and cons of their products versus holding the underlying.

Discussion on how their system of analysis of Options Greeks can be used to theoretically create a payout system for any highly liquid underlying.

How and where do your products fit into different trading and investment styles.

Some questions on Garretts' Background and non-technical questions

Where he went to school and his early investment, trading, and finance experience.

How do you recruit for your team?

What kind of books are on your reading list?

Next up in the week was a call with Jesse Greider of Private Equity Group

This was an internal training call with Jesse Greider, an expert on Fundamental Analysis and manager of his own Private Equity firm, which he's built from essentially zero to an AUM of $25 Million in two years. He's bought or sold a company every month for the entirety of 2022. That's almost as impressive as the AUM metric if you ask me!

For reference, here is a link to the video posted on YouTube (Shameless plug for one of Garen's YouTube channels, Algo's with Garen, where he posts all our recorded calls, explanations of strategies that catch his eye, and interviews with cool people like Garret Paolella!)

The products of the interview are a set of criteria, a wealth of information on how those criteria work with each other, and a strategy. You can use the criteria to get a shortlist of companies that are showing high-quality financial metrics, which you can dig deeper in to if you're looking to do some traditional buy and hold or swing trading. Who's got time for that though, we're focused on Algorithmic Investing here, so we built some Investment Machines out of it!

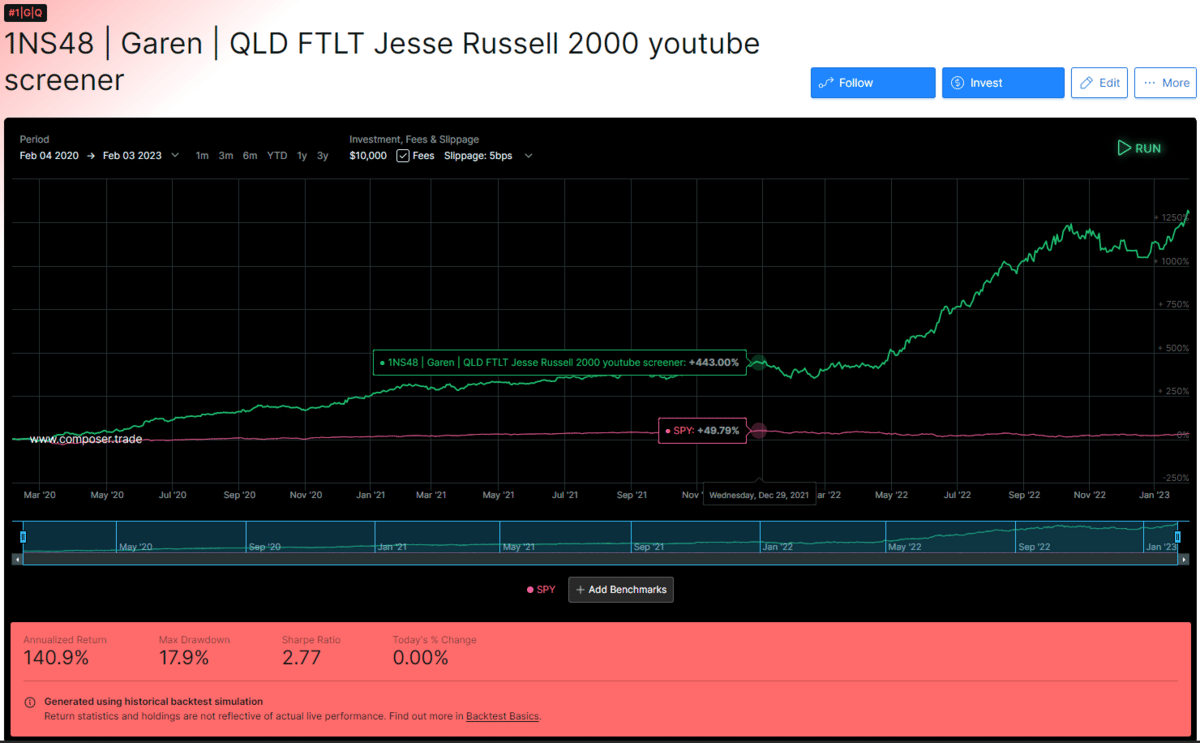

I present to you the QLDFTLT Youtube Screener, one of the latest concoctions from the mind of Garen Phillips.

Garen did a writeup of the symphony and associated design process over on Reddit (Linked for your convenience!), so I'll keep it short here;

This particular strategy is based on the QLDFTLT framework I talked about in our Second newsletter. It features a core of a mean-reversion bull/bear switch with a multi-layered RSI based rotator of select Industrial sector stocks based on the screener settings covered in the call.

The sector-specific rotator was inserted into the short side of the code, weighted against a split of an Anti-Beta strategy from the community (Shout out to Cashen#2274, Mayor of Safety Town) as well as 3 more layered RSI rotators populated with a selection of Russel 2000 stocks.

On the long side, we've got the classic 50/50 split of QQQ and the Industrials Rotator setup. Naturally, pairing Tech with Industrials may bring down the potential upside in a protracted, tech focused bull run. However in the event of choppy periods or a down market, you'll be in a position to catch whatever upside there may be, and not get hammered as hard on a downturn in tech.

I’m also officially putting out a call, if you’ve got a strategy with more than 90 days of live testing and you’d like to see it showcased in a future edition, DM Vox Machina#4863 over on the Discord!

That wraps up this weeks edition ladies and gentlemen, come to join the conversation over at the Discord Community. Good luck and happy trading!

Please note that the information provided is for general informational purposes only and is not intended to be financial advice. The information provided is not a substitute for professional advice and should not be relied upon as such. Always consult a financial advisor before making any financial decisions. Additionally, The Hard Road staff and contributors may have a stake in the Securities, Cryptocurrencies, Platforms, and other assets that are mentioned in this article and others.