I hope your Memorial Day was well spent, and your long weekend was restful and relaxing!

Before we get in to the madness of this weeks strategy, I want to take this holiday as an opportunity to thank all our past and current Service Members. I may not trust our government, but I have the utmost respect for those who dedicate themselves to the service of others. For your sacrifices, I thank you.

Now, this is a long one. Lets go!

I started down another rabbit hole recently, thanks to a post in the Discord Community. I have a fascination about different styles of portfolio management, especially ones that claim to be able to handle anything the market throws at them. This should conjure images of the classics, Ray Dalio’s All Weather Portfolio, The Risk Parity Portfolio, the classic Bogleheads 3-Fund portfolio, Harry Browne’s Permanent Portfolio, the list goes on and on. These form what I’d consider the bedrock of an education in portfolio management.

My reading has led me to the most hilarious and appropriately named portfolio management style I’ve encountered, and I’m proud to present my approximation of it to you today.

The Cockroach Portfolio.

The Cockroach Portfolio, created and named by the folks over at Mutiny Funds is an advancement on, and refinement of, the Permanent Portfolio by Harry Browne with heavy inspiration taken from the work of Artemis Funds’s Dragon Portfolio. (As discord users have noted, they’re based on the same logic and strategies with minor weighting differences.)

The thesis is simple, like any well explored concept. By allocating our investments thoughtfully and purposefully across multiple asset classes proven to do well across multiple market environments, we build a portfolio that should survive and thrive no matter how hard the market tries to kill it, just like its namesake cockroach. Seriously, if you’ve ever tried to get rid of a cockroach infestation, you know you want a portfolio that survives and multiplies like they do.

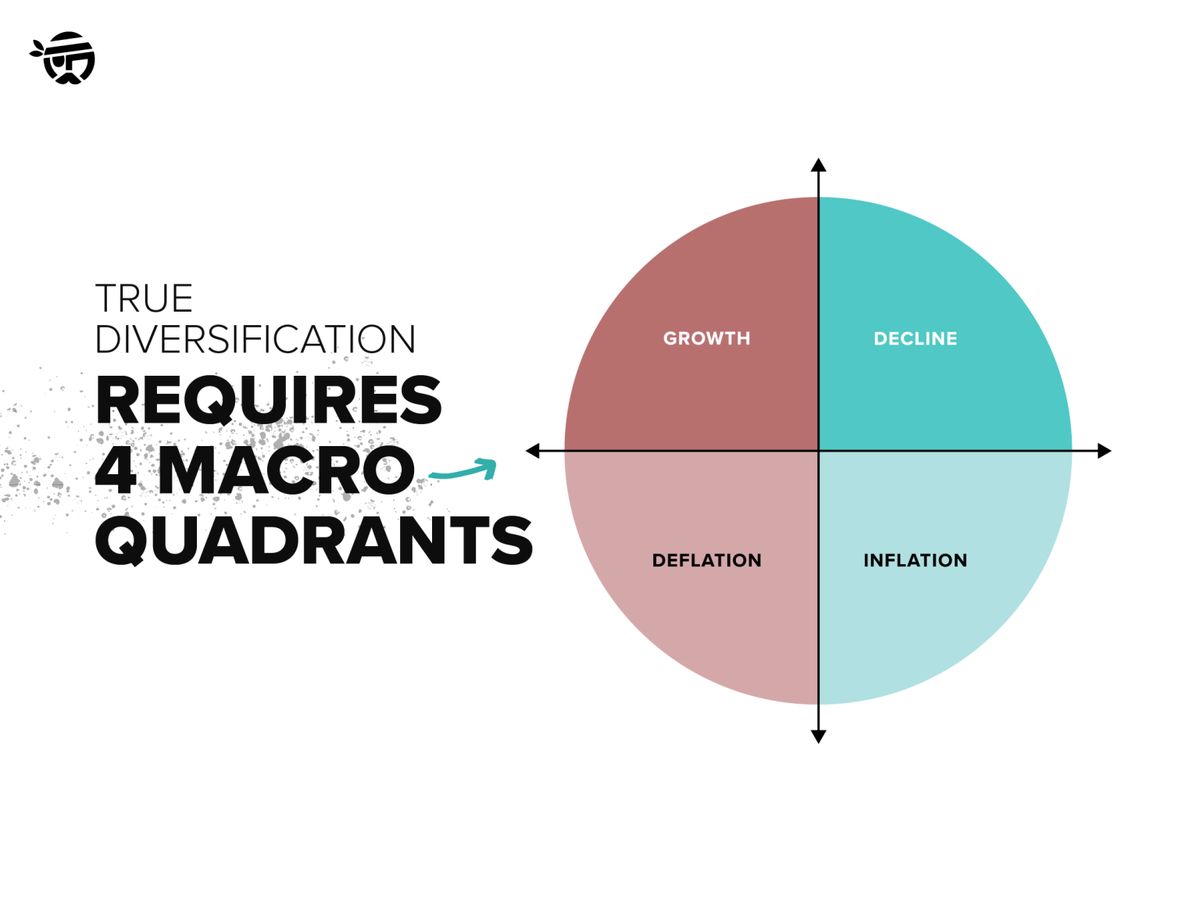

Harry Browne defined these environments as Growth, Decline, Deflation, and Inflation. You can call them macro regimes, market regimes, and a number of other things, but the core concepts behind them remain the same.

Credit to the folks at Mutiny Funds for making the above image.

Whenever I hear “weighted” and “rebalance,” I immediately start to think “how can not have to do all that work and still get the benefit?” This is where Composer comes in! There are two symphony links, one to a long-term backtest version that proves the validity of the concept, and another that is what I’m going to be running.

And as a forewarning, if you’re looking for infrequent trading, have an aversion to K1 forms, or don’t like non-fractionable shares, sadly this is not the symphony for you. Could it be done? I have serious doubts about the coverage of asset classes you’d be able to achieve if you eschewed K1’s, the entire Long-Volatility and Commodities sections would need to be scrapped and re-done. That said, I’d love to see what you, esteemed reader, are able to come up with!

So, whats this going to look like?

Well, the short version is that we’re going to have an allocation to 5 investment categories, the first switchup from the Permanent Portfolio’s 4 categories. The categories are as follows, each named roughly for the macro environment they are created to guard against.

Growth

This portion is dedicated to equities, mostly. Weighted at 20% of the total allocation, this is where you will find the majority of the actual “Stock” investments, in the form of ETF’s. Leverage is included in the baskets in effort to “juice” the returns.

Deflation

This is the home of bonds and income instruments, diversified across classes and the world. With Composers recent change to dividends being reinvested automatically, the implementation of dividend and income based strategies has become much more viable. One of the differences you’ll see between the “Long Backtest” and “Live Run” versions is the addition of international, municipal, and corporate bond sections. Additionally, the “Income” section has been completely rearranged to include assets that should theoretically appreciate faster than QYLD and the like.

Decline

The home of Volatility trading. VIX based assets like UVXY, VIXM, and VIXY can be powerful assets to hold in times of uncertainty. They are also the primary differentiation between the Cockroach and Permanent Portfolios. After several weeks of trying to come up with something compelling and different from things already shared in the community, I didn’t feel like I had managed to do it. Thus, this is the section with the least input from me.

Inflation

So this is my second favorite section of the entire symphony. Despite my work on the Battleship family of symphonies, I’ve never felt like we’ve had a truly commodity focused strategy. This section, however, is exactly that. I’ve managed to successfully remove (almost) all the equity risk and maintain exposure to (almost, damned volume limits) every major commodity class.

Cash and BTC

I’ve added an allocation to Cryptocurrency in the “Cash and BTC” section, which Mutiny would call their “Core”. I’ve moved their Gold allocation to the Inflation/Commodity Trend section for the sake of organization.

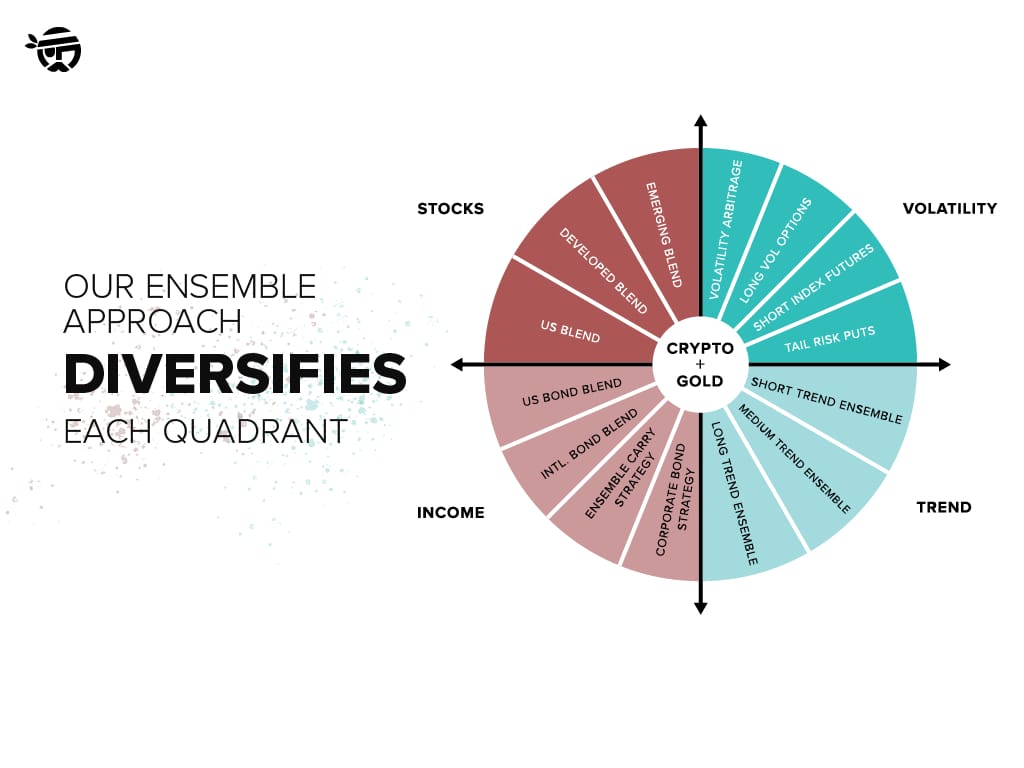

Mutiny Funds has done the world the service of putting together these helpful infographics to help educate us on the strategies.

You should see some similarities to how I’ve laid my organization system out

The Trend Substrategies

Beyond the compilation of this symphony, my largest contribution to this is the creation of several sub-strategies to fulfill the purpose of tracking general market trends and scaling into and out of positions based on those trends. Using a combination of RSI to find things in baskets to buy and Moving Averages of Returns over Weekly, Monthly, Quarterly and Yearly timeframes, I’m satisfied that the strategies fulfill my goal of allowing me to scale into and out of exposure of various assets and classes.

Okay, thats cool, but show me the numbers.

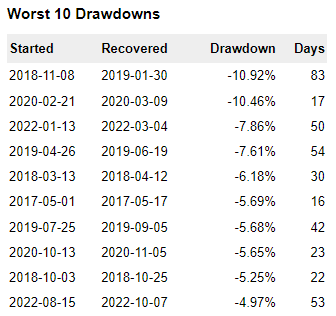

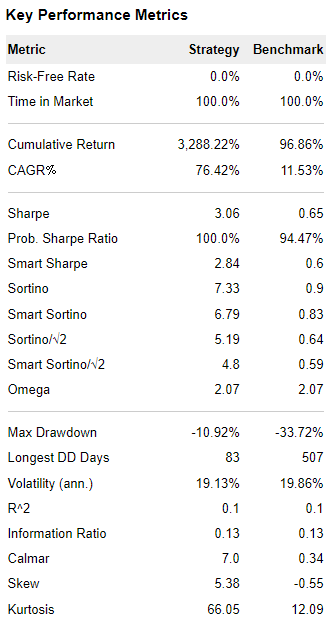

Well, lets start with my two favorite stats, drawdowns and returns. All numbers are drawn from the 2017/Long Backtest version.

That is correct, in the last 5 years this strategy has supposedly suffered a maximum of 11% drawdown that lasted a little less than 3 months. On one hand, this sounds like it would be incredibly overfit, but on the other hand diversification and survival is this strategies entire purpose.

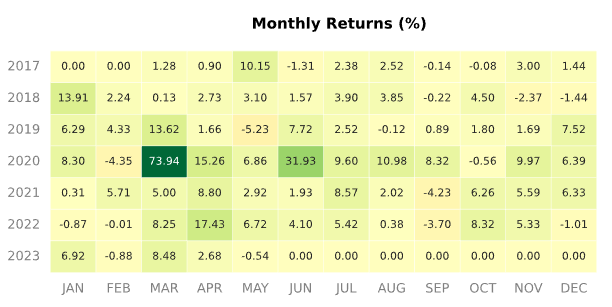

Now this is where I start to question myself. Would this strategy really have made 80% off of the Covid Crash? Does this strategy really average out to around 4% gains per month? These are the kinds of numbers that make me question my sanity, and the validity of the strategy. But I’ll be damned if they aren’t appealing.

And there is the juicy bit, a Compound Annual Growth Rate of an absurd 76.42%. If this is accurate, our community is set up to be the next Renaissance Technologies. I’ll believe it for real in 10 years.

Okay, so the stats on this thing look impossible and it sounds like you don’t even believe it, whats the catch here?

Well, there’s a couple. Lets go over them, because the downsides are as important as the upsides.

The weights can get really out of whack in times of volatility.

Thanks to the inclusion of multiple sections and multiple methods of checking for volatility a large amount of invested capital, relatively speaking, can wind up in VIX tracking assets. Technically speaking, this goes against good portfolio design principles but I feel like the upsides, increasing AR and lowering dependence on the market SPY/QQQ doing things for our gains, outweighs the potential issues.

If you aren’t able to automate it, tracking this strategy outside Composer is basically impossible.

At any given time this strategy trades 45-90 tickers. Getting the signals at 3:50 then attempting to manually make these trades in the 10 minutes, while not liquidating whole positions sounds nearly impossible to me.

Non-Fractionable shares

TYD at 1%, ZSL at 1.6%, VIXY at 1%, and VIXM at a whopping max of 8.3%. Without screening every individual ticker for fractionality, as that was not a goal or concern in the design process, this is what I’ve found to be non-fractionable from the possibly incomplete community-maintained list of tickers that can’t be fractionally traded. So, lets try to work out what the smallest dollar value this symphony can safely trade is. Lets say a theoretical maximum of 12% of the total allocation needs to be in non-fractionable assets that have a maximum price of 40$ each. Using an equation of (Maximum Price x remaining percentage), we get a total of $3520. As Discord member Sandypants#7720, creator of the Dragon family of symphonies has reminded me, messing with non-fractionable shares is annoying and can mess with your symphonies tracking, as it’s almost impossible to be 100% invested at any given time. Perhaps I’ll address this in a future update to this strategy.

Schedule K1 Forms

There are lots of them. Nearly everything in the commodities section is going to issue a K1 form come tax season. They can be time consuming and annoying to deal with, please keep this in mind.

And there we have it.

Thats going to do it for this weeks edition. The long weekend paid off with a double-sized newsletter this week, and a creation that has been weeks in the making for me personally, and one of my proudest creations. I hope you enjoy it as much as I enjoyed the process of learning about the philosophy, and attempting to faithfully implement it!

We’ve got another Coder Collaboration meeting coming up on June 4th, I hope to see you there!