Bond Land is having a time.

So, Jerome Powell had another meeting on Wednesday. If you didn’t watch it live, he effectively admitted that the “soft landing” the Fed has been touting as the inevitable outcome of their interest rate policy is not the “base case” any more. It’s now their “goal”

On top of that, the “Dot Plot” the FOMC releases every quarter came out Wednesday, and signaled things that the bond market didn’t exactly want to see.

The TLDR is that there is yet another hike potentially on the books for 2023, which stands in sharp contrast to the March dot plot, which also predicted 1 more in 2023. We all know how that turned out (their projection was wrong.)

In addition to the revelation there are more hikes on the table for 2023, rate cuts for 2024 were pushed further and further back. And with energy prices climbing, who knows if they won’t get pushed back further. The result of this new uncertainty? Lets see.

US 2Y Yields

2 Year bond yields are 10 Basis Points off of their 2006 highs, before the Global Financial Crisis pushed us in to the Zero Interest Rate Policy (ZIRP) world we’ve been in for nearly a decade and a half.

Its the same story for the 10 year, we’re at levels unseen since the last financial catastrophe.

Long time readers may know that I’m perpetually uncertain of market conditions, and this last week has only convinced me that it’s a smart move. There are multiple factors feeding in to this, and my present thought that we’re closer to the state of the 1970’s than anything else. Lets discuss.

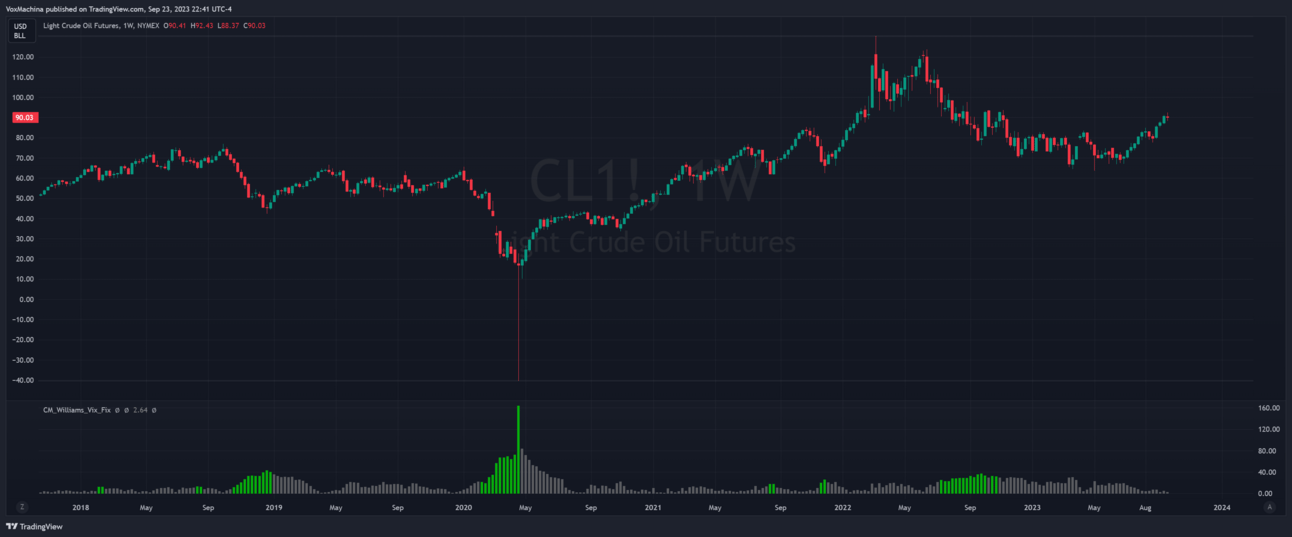

Crude oil prices moving higher over the last two weeks, arguably the last 3 months

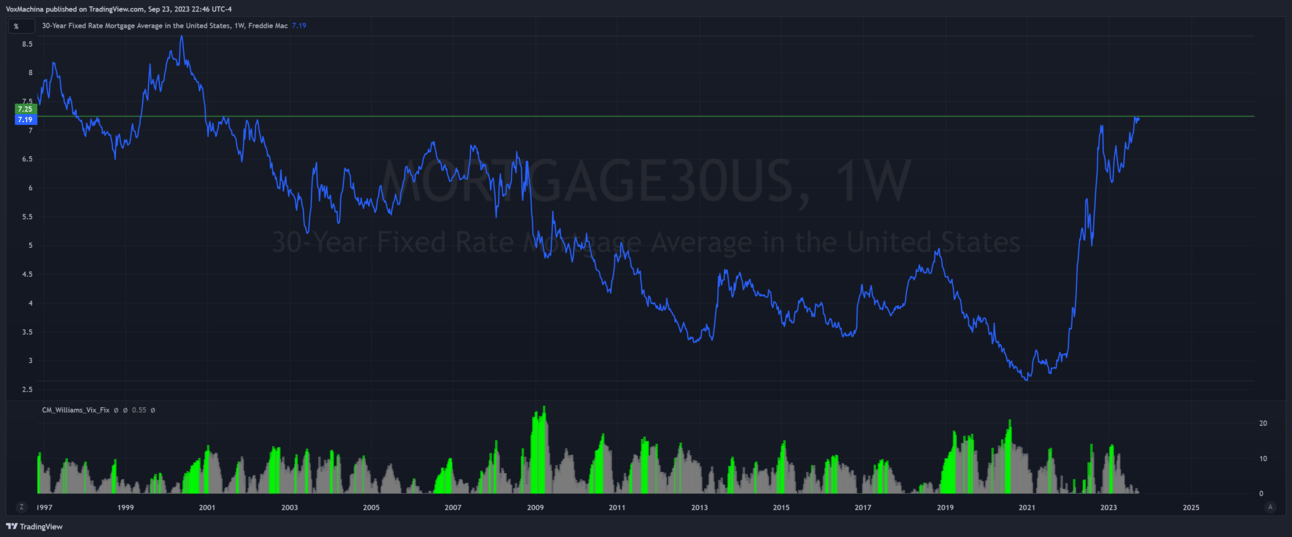

Average mortgage prices are as high as they’ve been in a long time. I’ve heard rumors of mortgages north of 8% being confirmed after Wednesdays meeting, but I cannot confirm anything about that.

The importance of this cannot be overstated. The sheer volume of money that will be sucked out of the economy this fall is massive. The question at this point, is it priced in? Only time will tell.

So what’s the verdict on all this info?

Well, personally, one of the only things that I’m certain of is how stupid it is to fight the Fed. Fed says “soft landing” is not the base case, I say okay, I’ll take JPow at his word. The Yield Curve is starting to un-invert, which means something is coming, one way or the other. Do your best to prepare for uncertainty, however you see fit.

That’s gonna do it for this week. Be safe my friend.

Garen is hosting free 1 on 1 calls for the next two weeks, and spaces are filling up quick!

Week 1 is already completely full, and week 2 is filling up quick. If this is the first you’re hearing of this, the Discord Community has a 3-4 day head start on you filling these spots up. Grab yours if you want to chat, next time its gonna be $$.

If you’re not already in the Discord, what are you even doing?