Back again with another lesson on what not to do.

Today, we’re going to be going over Cluster Failure, or in simple terms “When you think you’re diversified, but you’re actually not. Shout out to the Discord User who will remain nameless for giving me the inspiration for this lesson.

Lets go to ChatGPT for a definition of Cluster Failure in the context of Algorithmic Investing, shall we?

In algorithmic investing, cluster failure refers to the simultaneous malfunction or poor performance of multiple trading algorithms within a portfolio. This can result from errors in the algorithms themselves, data feed problems, market anomalies, or unexpected events. Cluster failures can lead to significant losses if not managed properly, as the algorithms' combined actions can amplify negative impacts. To mitigate cluster failure risks, algorithmic investors often employ diversification strategies, monitor portfolio behavior closely, and implement safeguards such as circuit breakers or halt mechanisms to pause trading during abnormal market conditions.

Thanks ChatGPT. Very good.

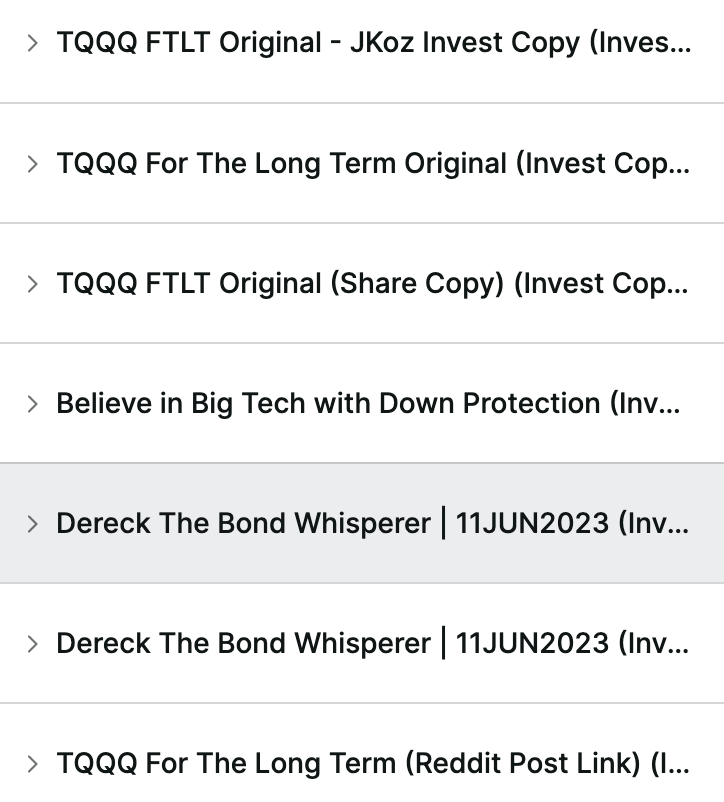

With that out of the way, the above screenshot is a textbook case of cluster failure waiting to happen.

But Jake, 7 strategies makes a reasonably diverse portfolio, right?

Wrong.

At least in this situation. Out of the 7 symphonies you effectively have 3. You can debate the “correct” number (meaning there isn’t one, but I digress.) Personally, I prefer 10 or more with 2-3 different bull vs bear market checks. The catch is, those 10 needs to be reasonably different from eachother. Not 4 copy/pastes of almost the same strategy.

There is a right way and a wrong way to run very similar strategies that allows each to contribute its strengths and weaknesses. This is not the right way.

Then what is?

I’m glad you asked! In the words of .BrianE, one of the communities long-standing Master Architects, mash them together.

In this context, it means taking all 4 of the FTLT variants from the screenshot at the top, and making them in to one Master Symphony. You lose the ability to track each strategy individually, but it is the most efficient way to run it.

Your other option is to just allocate your capital accordingly.

This means that if you have $10,000 in your account and you’re trying to allocate to 10 variants of FTLT, and 9 other strategies, you would put $1000 in to each non-FTLT strategy and $100 in to the 10 FTLT variants. The pro of this method are that you can track each ones performance individually. The con’s are that they won’t balance back and forth between themselves, and you may run in to issues with non-fractionable tickers (if there are any present in your strategy.)

Okay, so what am I supposed to do with this information?

Very simple solution, if you read the fucking logic of your strategies and they’re visibly the same, treat them as the same symphony when dividing your money up.

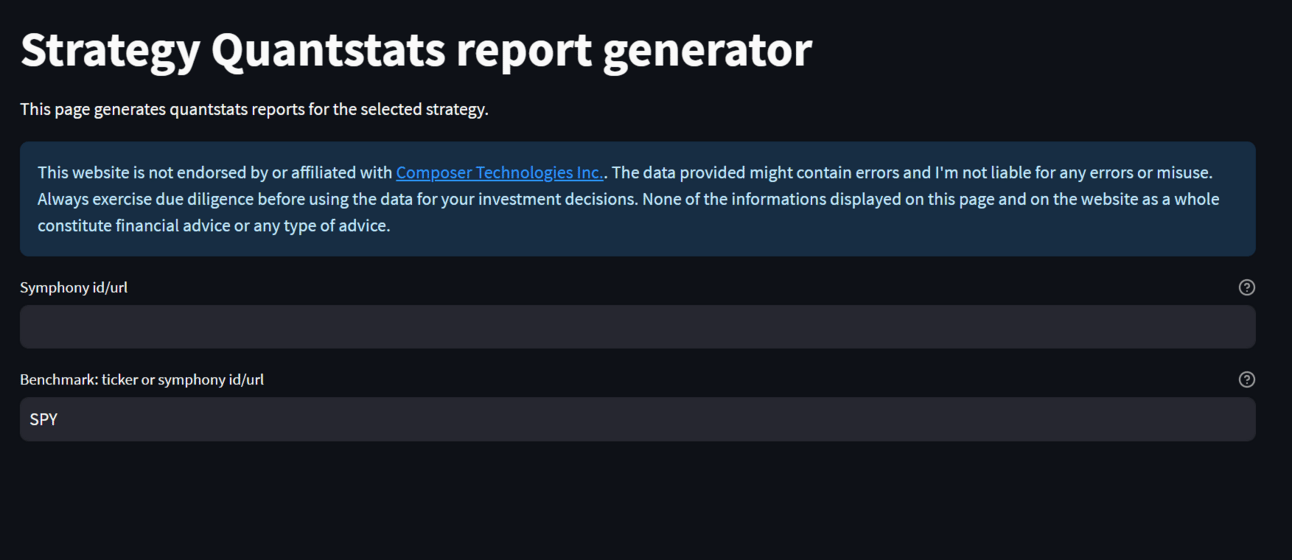

If they aren’t visibly the same, step 2 is to run them through the Quantstats Analysis Tool make by Raekon.

Feed it the URL’s of any strategy or 2 strategies you want to examine or compare. One as the strategy, one as the benchmark. I like to use Composers classic 60/40 as a benchmark, because I’m a conservative old man trapped in a younger mans body.

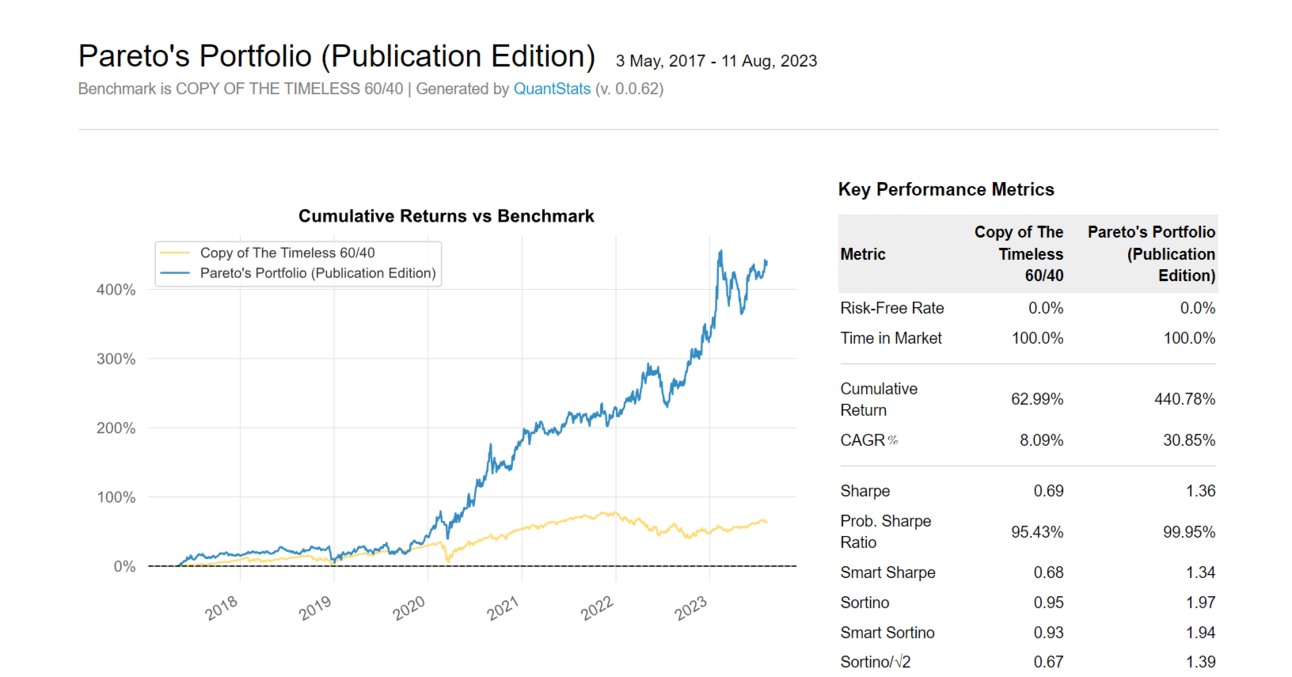

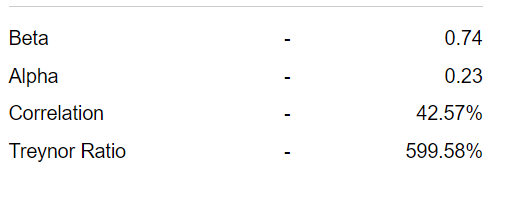

It’ll spit out a page just like this one,

You’ll want to scroll down to the bottom and look for the following section, containing the “Correlation” statistic.

As you can see, Pareto and the 60/40 are fairly correlated. Definitely not an independent mover, but they don’t always agree. I’ll leave you to search your portfolio and figure out just how diversified you really are!

Show me what you’re at over on the Discord!

Looking for a deeper dive?

/